A Financial And Tax Planning Strategy For This Week's Stock Market Plunge

Published Friday, September 23, 2022 at: 8:06 PM EDT

Here’s an update on this week’s financial economic news, informed by financial and tax planning and a perspective suited to investors seeking to build a retirement income portfolio or building a legacy for the next generation.

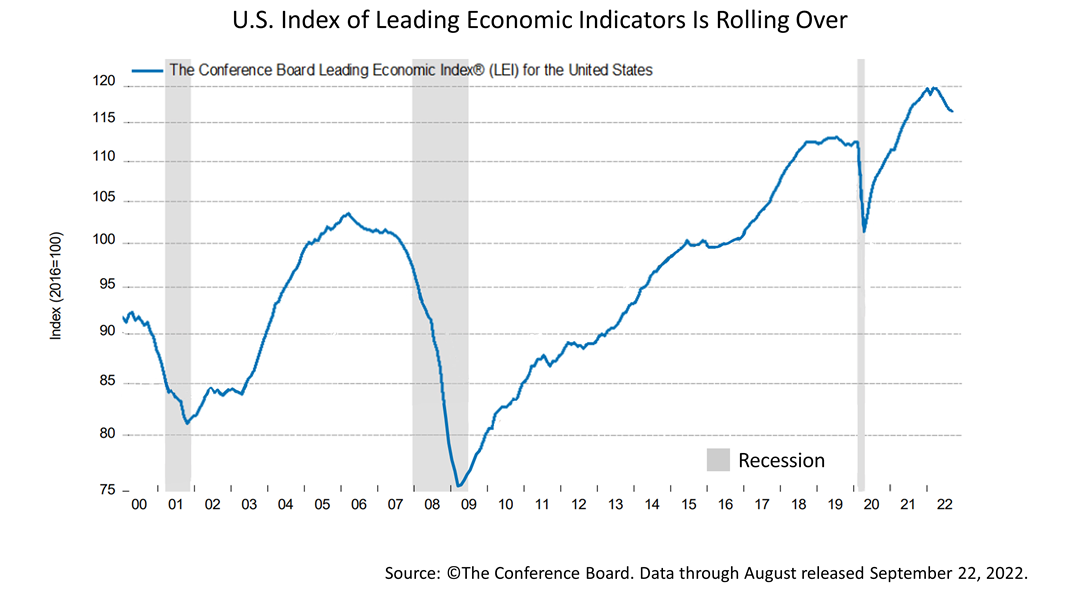

- The U.S. Index of Leading Economic Indicators (LEI) declined for the sixth consecutive month, and economists at The Conference Board, who compile the data on the 10 indexes that comprise the LEI every month, for the first time in about 15 years projected a recession in the coming quarters.

- The Board of Governors of the Federal Reserve System voted unanimously Thursday to approve a three-quarter of 1% increase in the rate at which it lends money to the nation’s largest banks to 3.25%.

- The Fed funds rate hike was widely expected, but the Standard & Poor’s 500 declined nonetheless as the bear market plunge sent some investors to the sidelines.

The Standard & Poor’s 500 stock index closed this Friday at 3,693.23. The index lost -1.72% from Thursday and -4.65% from last week. It was -22.5% lower than the January 3rd all-time high and has gained up +65.06% from the March 23, 2020, Covid-19 bear market low.

For retirement income and investors building wealth for the next generation:

- The current downturn may be no surprise, but it still may make you doubt your portfolio’s strategic asset allocation. Contact us with questions.

- With one week left before the end of a brutal quarter for stock allocations and the Fed’s rate hike campaign expected to continue for months, the quarterly performance figures on portfolios held by prudent long-term investors are going to be discouraging. But history – which is not a guarantee of your future investment results – indicates that the U.S. economy has recovered from every recession in the past and continued to grow, and this is the main driver of your long-term investment strategy.

- Instead of focusing on the ups and downs of the stock market, consider steps you could take to reduce your tax bill by December 31, 2022. A confluence of events that includes the bear market, new tax law contained in the recently-passed Inflation Reduction Act tax rule, and changes to tax regulations on IRAs and qualified retirement plans, that went into effect for the first time in 2022, along with new tax law expected to be enacted in November or December, make the final three months of 2022 a crucial period for planning a tax efficient retirement income stream and legacy.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding