Fed Chair: "We Remain In Extraordinary Times."

Published Friday, October 5, 2018 at: 7:00 AM EDT

Not since the 1950s, Federal Reserve Board Chair Jerome Powell said this week, has inflation and unemployment remained so low for so long.

Speaking in Boston on Tuesday, Mr. Powell depicted a throwback to economic conditions seen only briefly in post-War U.S. history, and fresh data released Thursday and Friday reinforced Mr. Powell's "remarkably positive outlook."

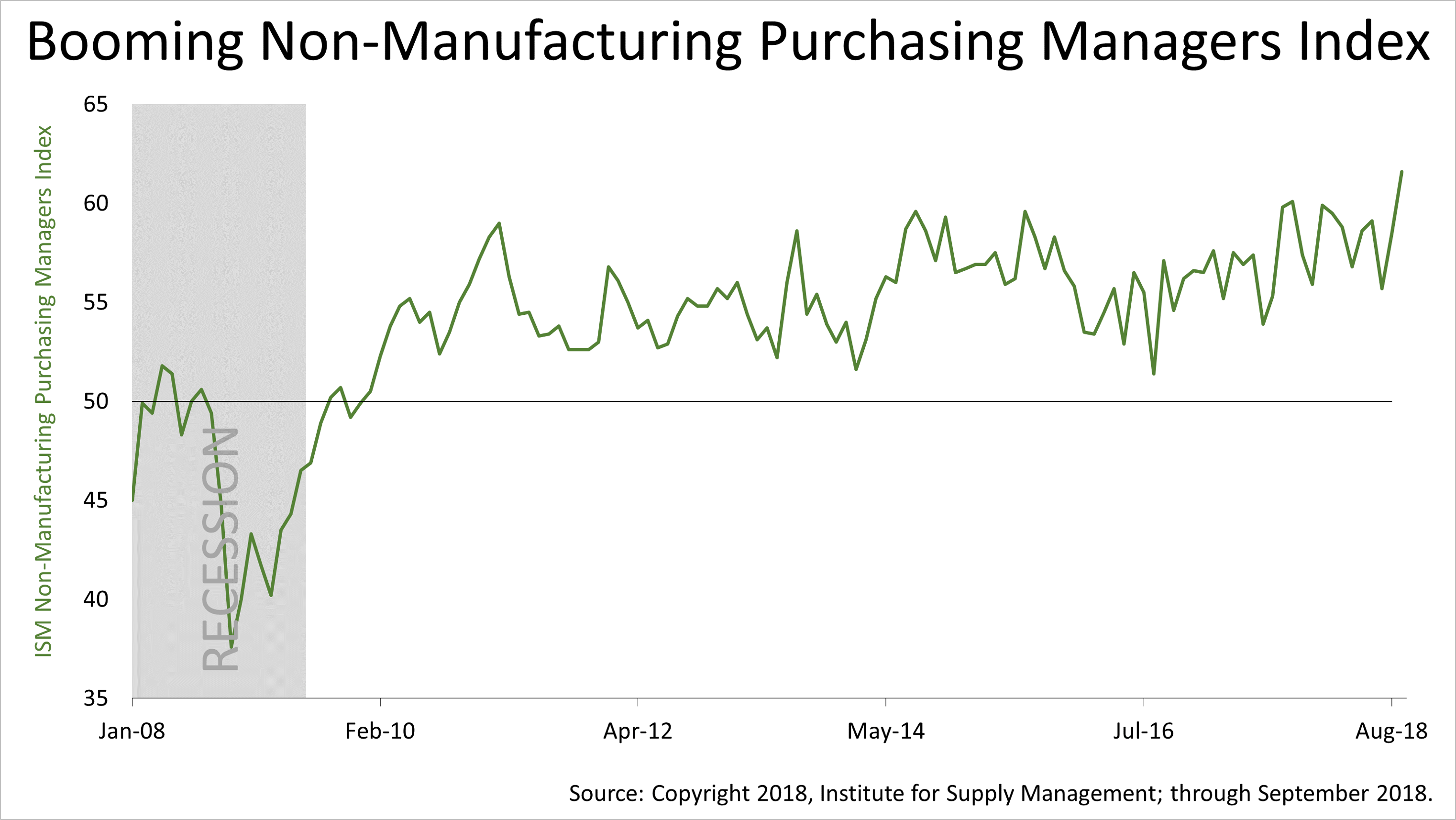

In the 88% of the U.S. economy outside of the manufacturing sector, purchasing activity soared in September, climbing to the highest level since inception of the index in January 2008. According to Thursday's report from the Institute for Supply Management, the forward-looking new orders component of the index slowed slightly from August but remained very strong.

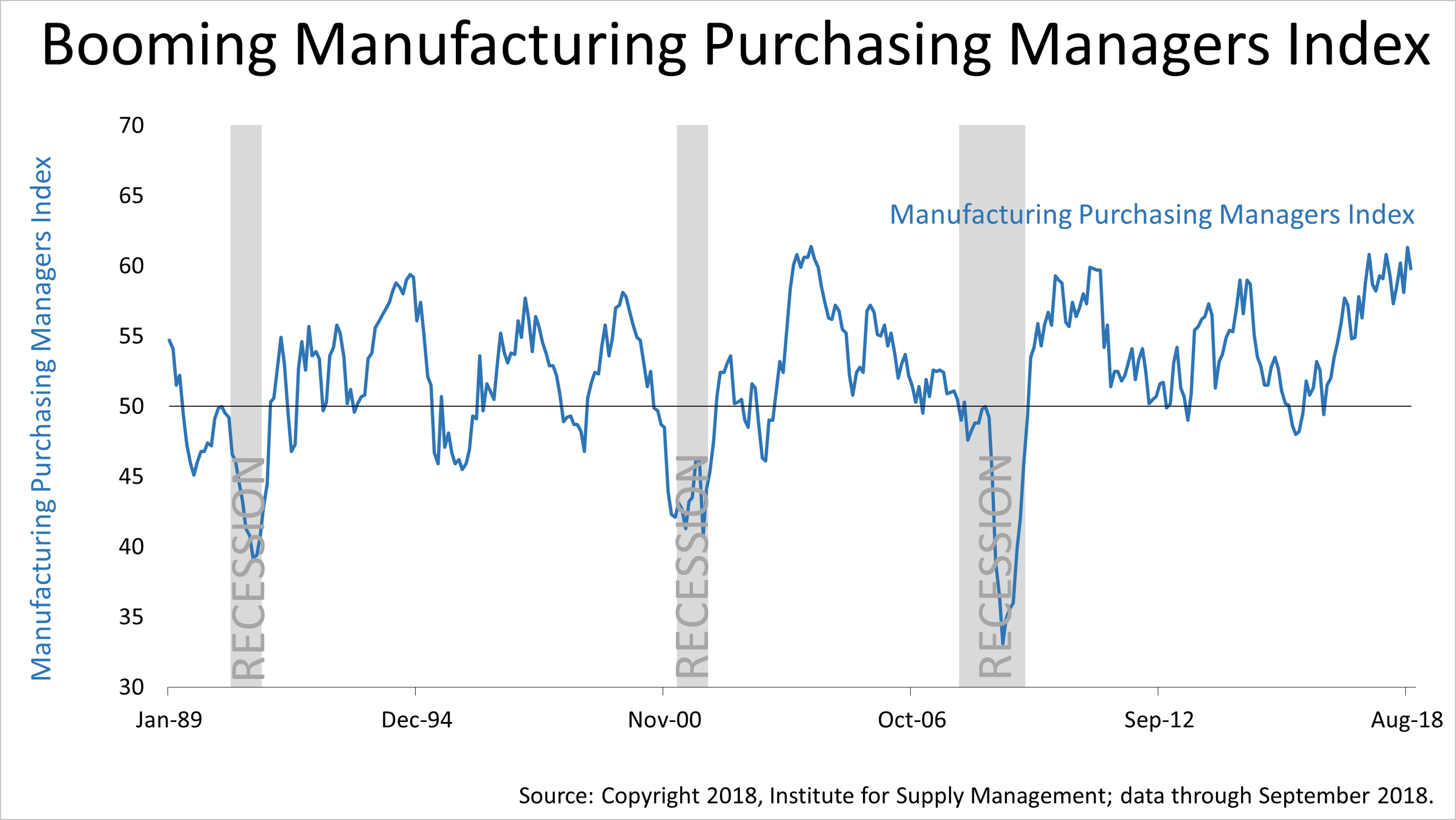

Purchasing activity, at the 12% of the economy in manufacturing, also remained in record territory.

In the three decades since purchasing activity in the manufacturing sector was first collected monthly by the ISI in January 1989, the index rarely has been as high as in September.

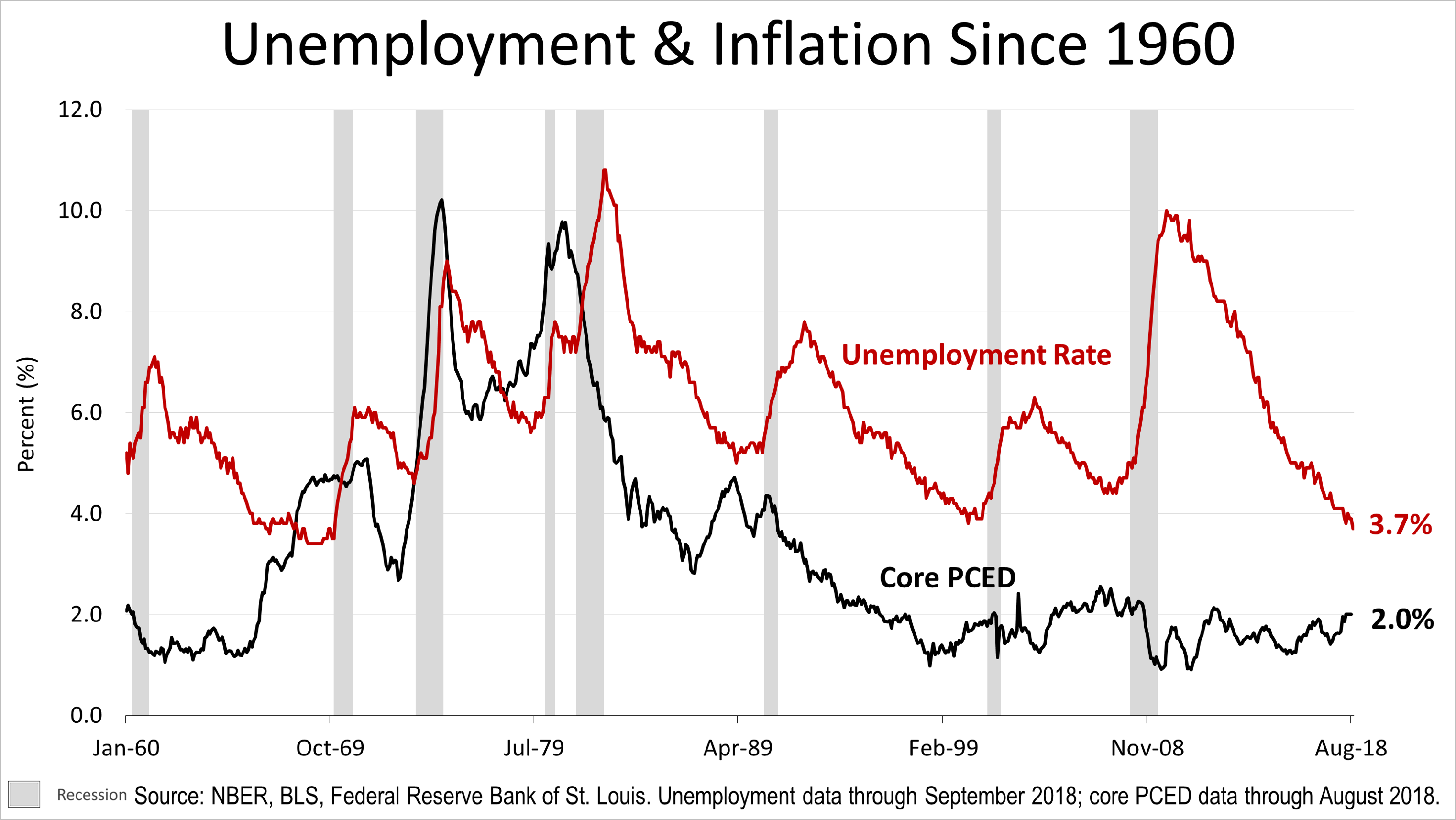

Meanwhile, the Labor Department said on Friday that unemployment, from its record low in August, ticked lower in September — as low as it's been since 1969.

Remarkably, core inflation, which excludes volatile monthly expenses from a consumer's monthly expenses, didn't budge. Growth without wage inflation accurately describes economic conditions currently, and in his speech, Mr. Powell said he expected more of the same in the months ahead. Core inflation has been "anchored" at 2% for 20 years.

"We remain in extraordinary times," Mr. Powell said in his concluding published remarks at Tuesday's annual gathering of business economists. "I am glad to be able to stand here and say that the economy is strong, unemployment is near 50-year lows, and inflation is roughly at our 2% objective. The baseline outlook of forecasters inside and outside the Fed is for more of the same."

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding