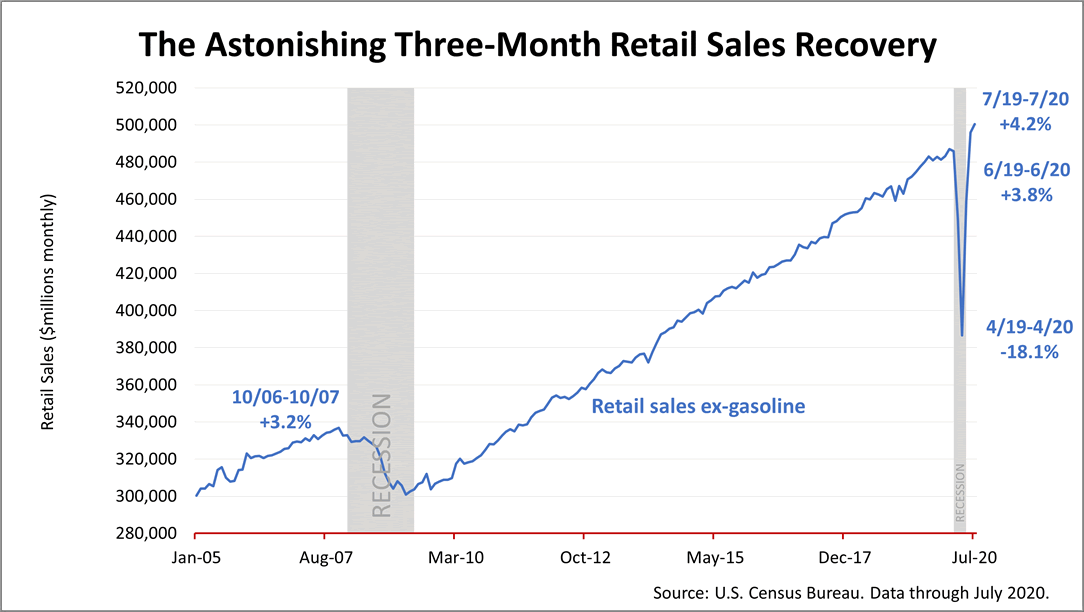

As If Coronavirus Never Hit, Retail Recovers

Published Friday, August 14, 2020; 7:30 p.m. EST

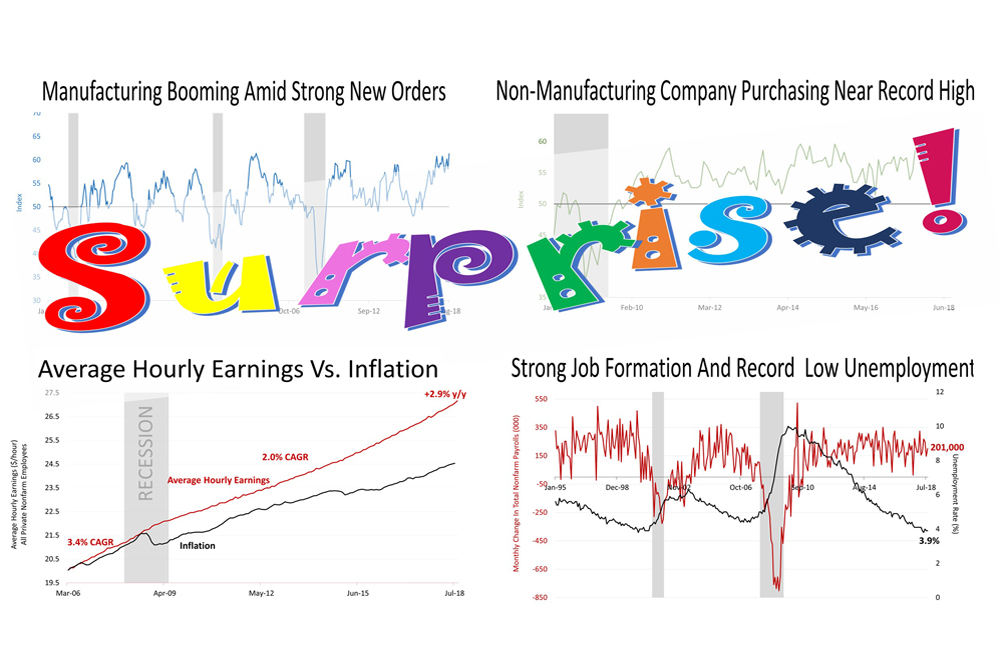

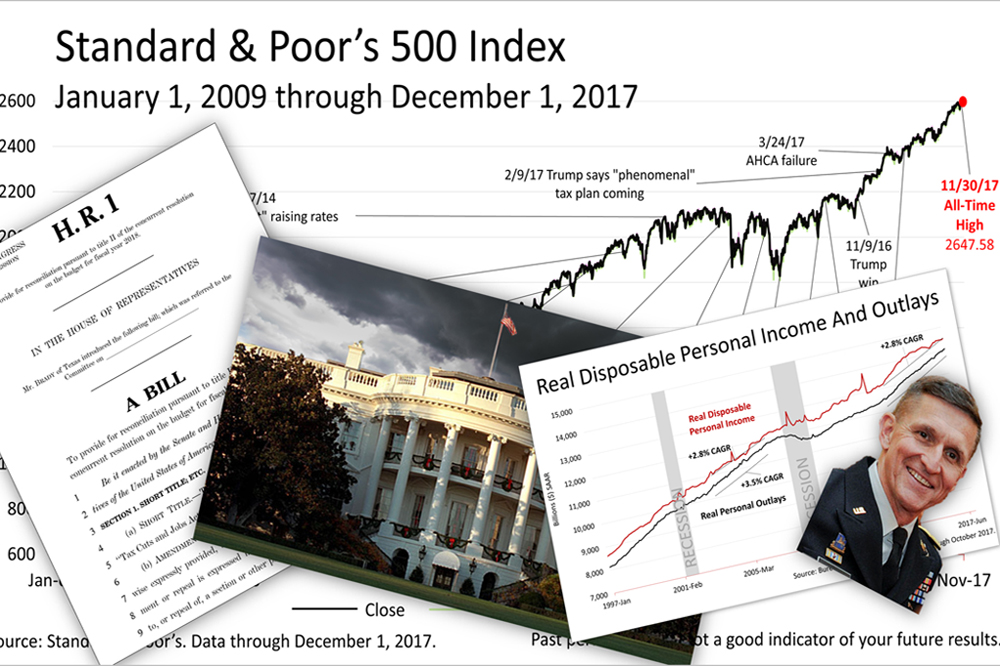

(Friday, August 14, 2020; 7:30 p.m. EST) As if the coronavirus crisis never hit, retail sales, according to today's data from the U.S. Census Bureau, are back on track with their growth rate before the outbreak.

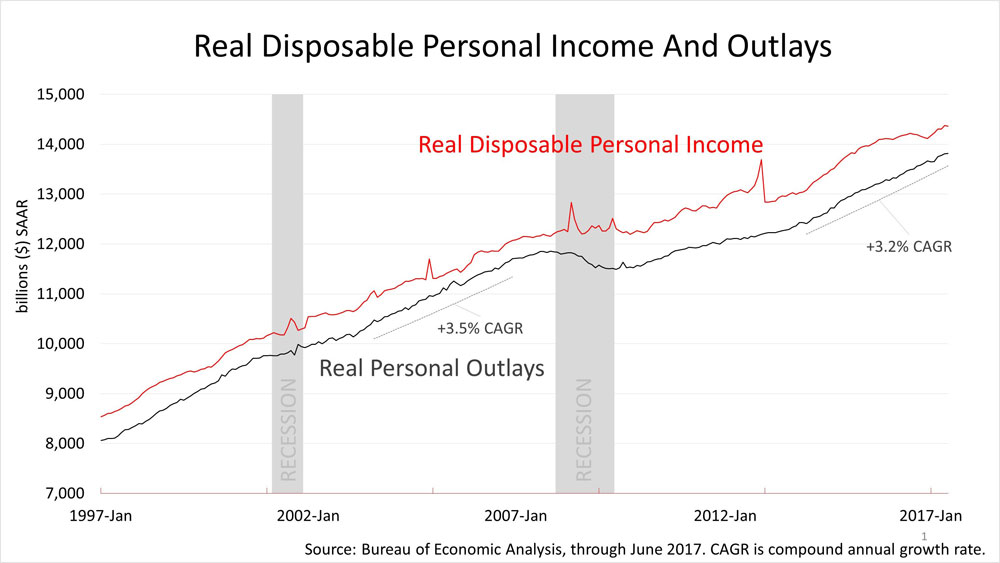

CARES Act stimulus, in the form of $1200 checks, $600 weekly unemployment bonuses, and Small Business Administration transfers to businesses, fueled the V-shaped-and-then-some recovery.

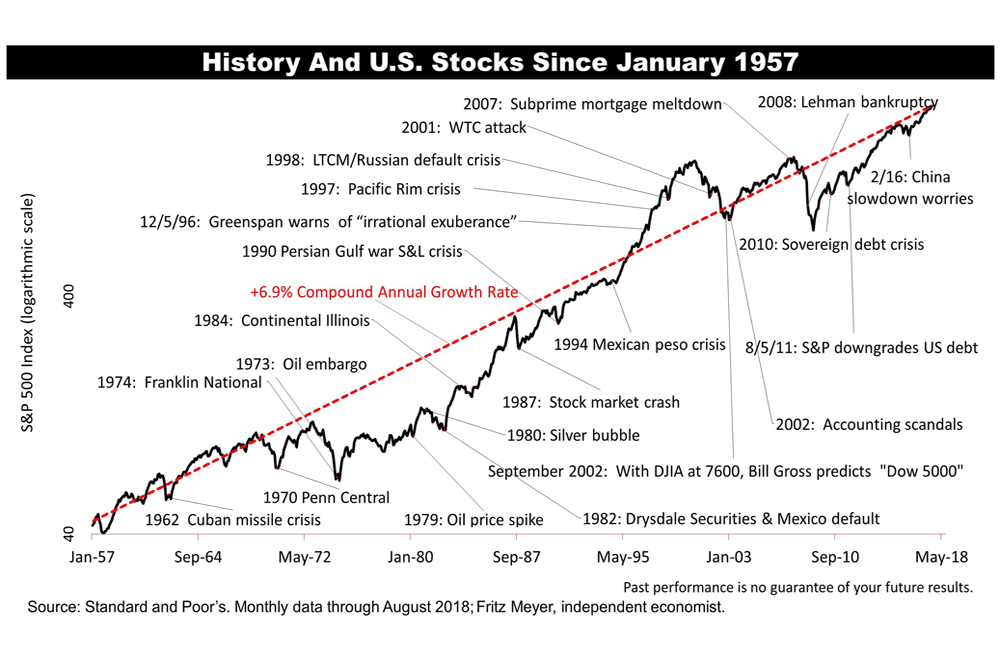

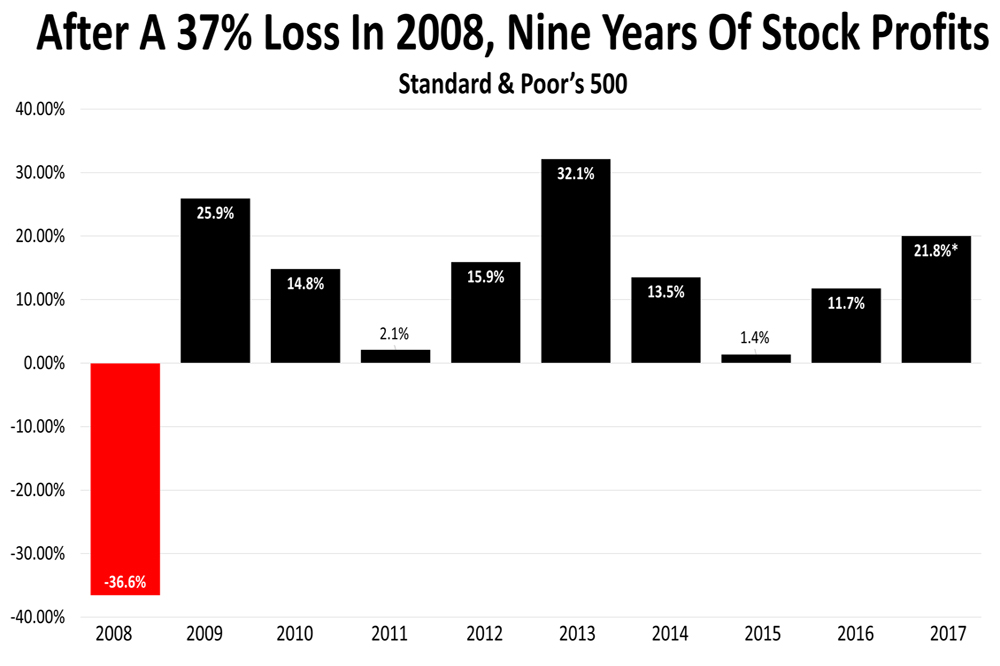

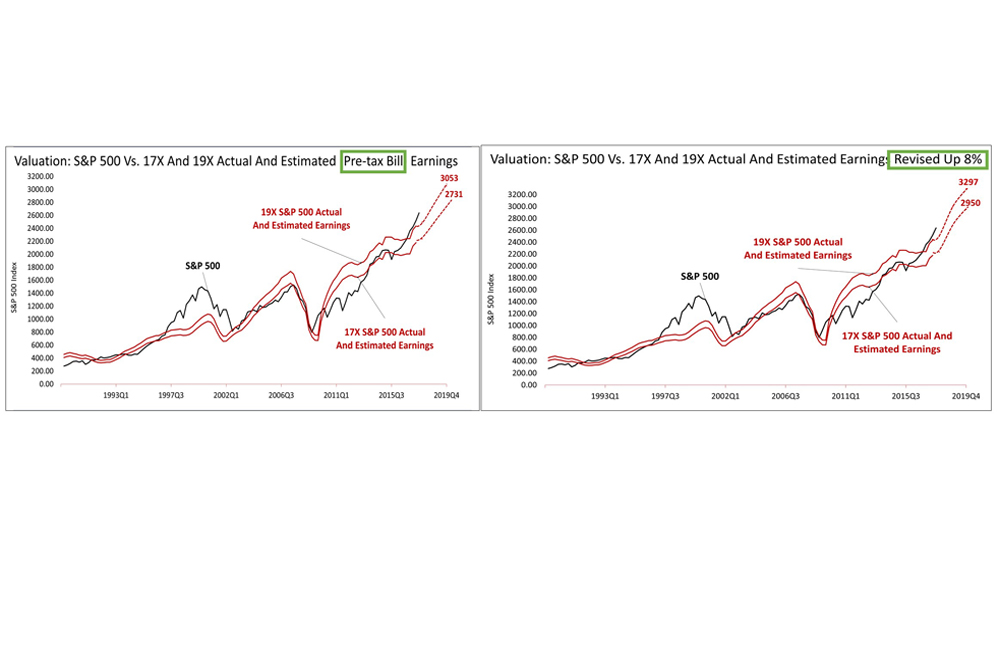

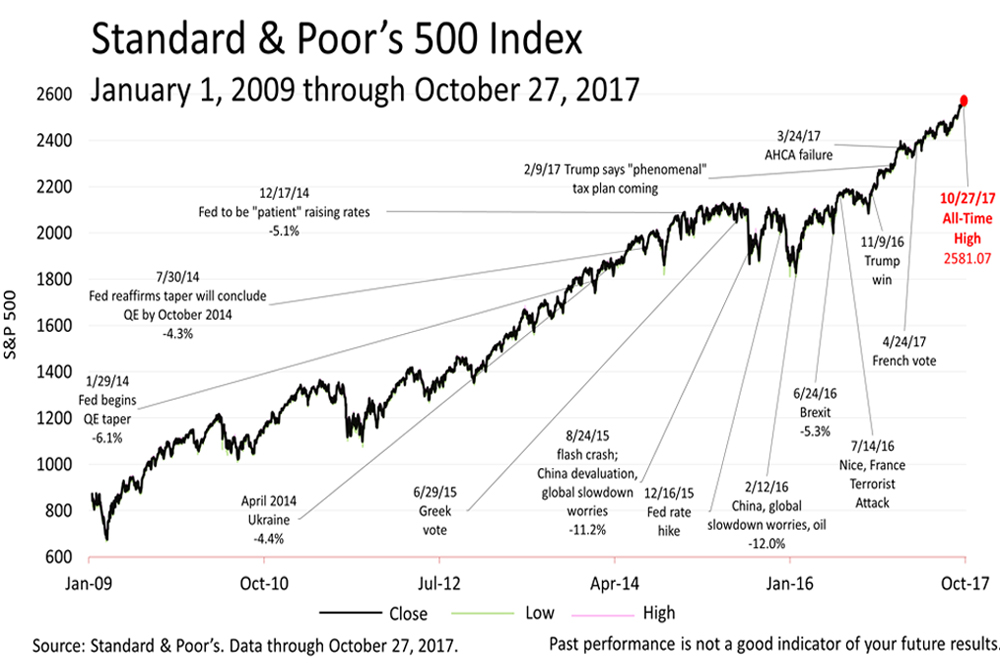

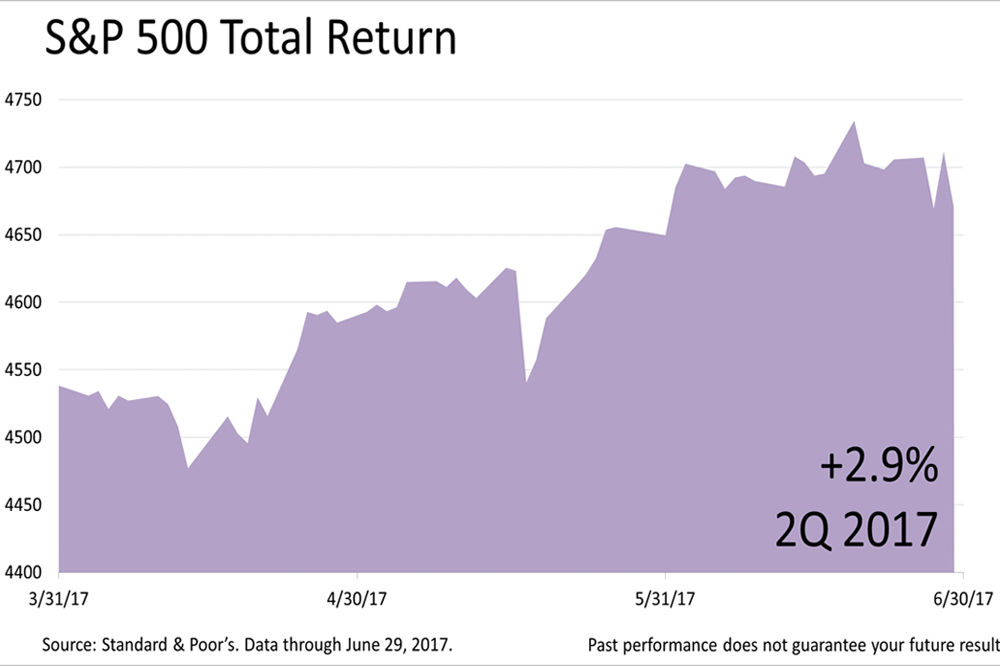

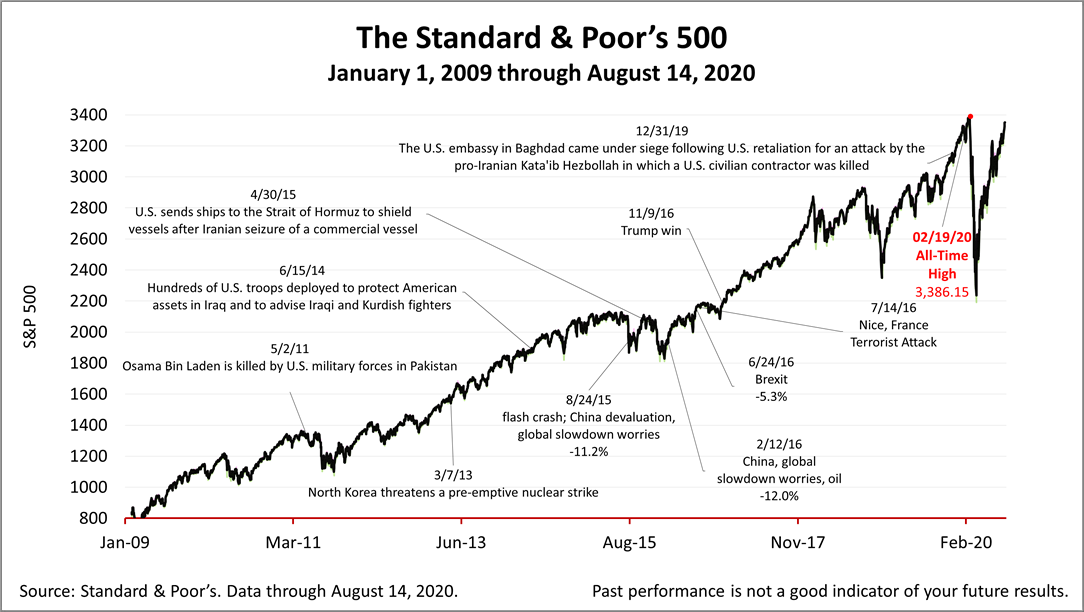

The Standard & Poor's 500 stock index closed Friday at 3,372.85, a fraction off the record high of 3386.15 on February 19, 2020, when the pandemic began a plunge in U.S. stock prices.

The S&P 500 closed up +0.64% from a week ago and +40.47% than its March 23rd bear market low.

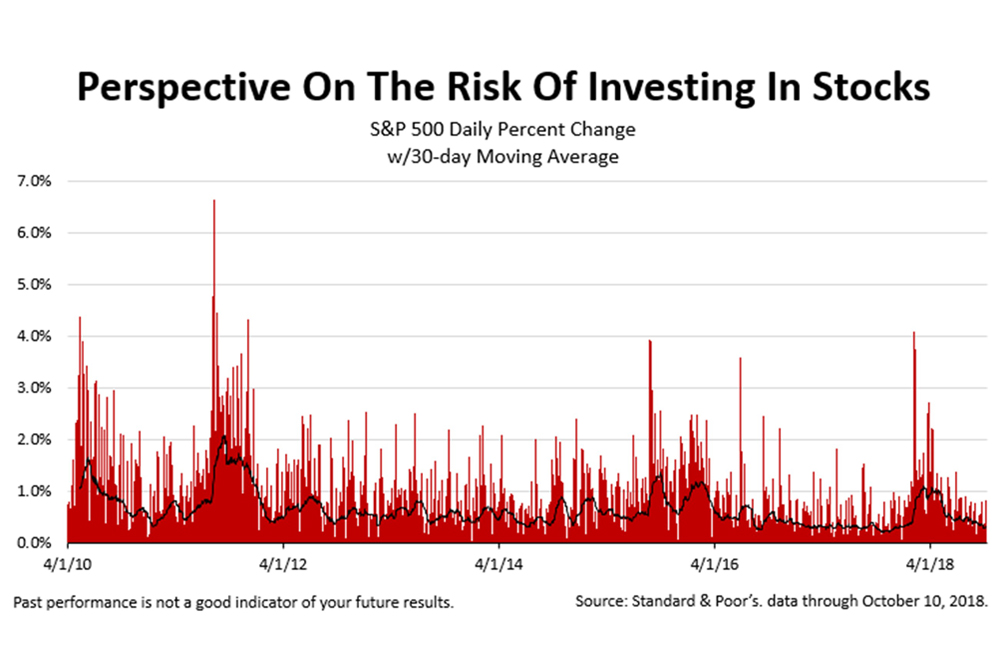

Stock prices have swung wildly since the crisis began and volatility should be expected in the months ahead.

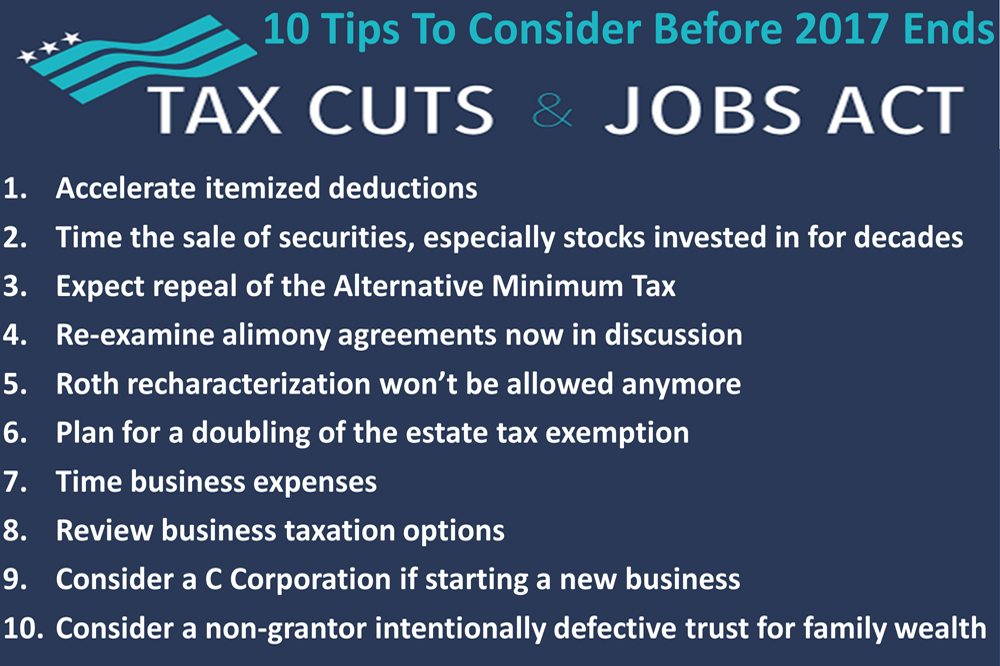

Volatility in the price of stocks, real estate and other assets, along with emergency relief in CARES Act amendments to the U.S. tax code, create an array of new tax planning strategies that can materially affect your long-term financial plan, and some of the new opportunities must be acted on before the end of 2020. Please contact us for information about your personal situation.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding