Holiday-Shortened Week Ends With Stocks Little Changed, Despite D.C. Drama

Published Thursday, December 24, 2020 at: 3:58 PM EST

An unexpected pocket veto by President Trump could cause a government shutdown and delay adoption of the $900 billion economic stimulus and aid to individuals and businesses that was approved by Congress earlier this week, the bill is almost certain to become effective within weeks, which is why stocks closed the holiday-shortened week little-changed and a fraction away from its all-time closing high.

The pocket veto is a shrewd maneuver. An outright veto could be overridden by Congress, but a pocket veto cannot be overridden for 10 days. By then, Congress will be back home, further delaying the $320 billion aid for small businesses.

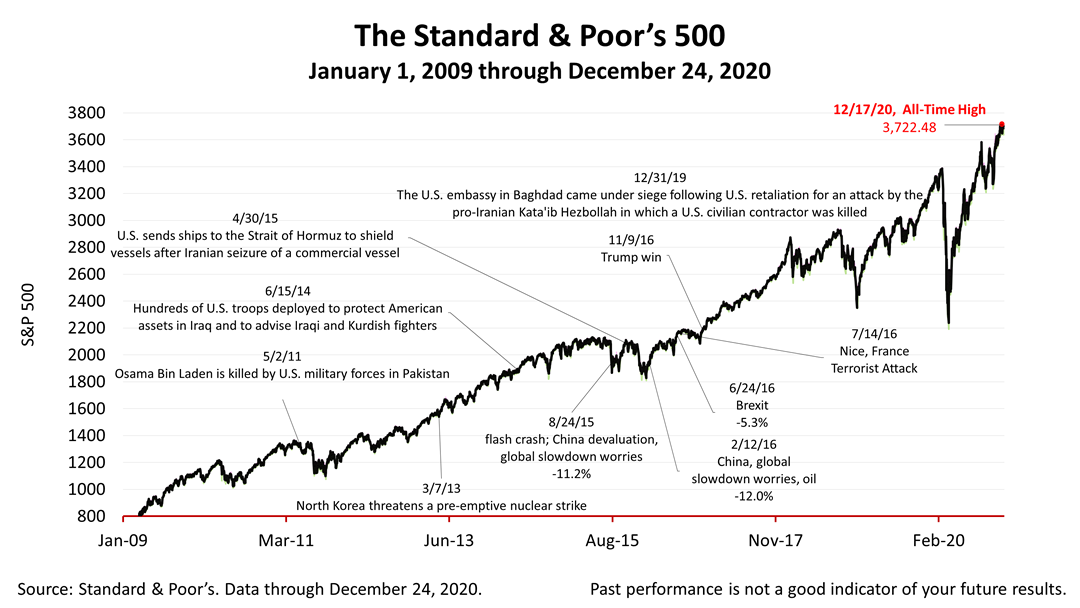

Although exactly how the political drama in D.C. will play out remained unclear, the stock market was unfazed. Trading in the Standard & Poor’s 500 stock index, which closed at 1 p.m. for Christmas Eve, gained +0.35% from Wednesday, lost -0.17% from last Friday’s close, and was up a whopping +49.34% from the March 23rd bear market low. At 3,703.06, the index was fractionally off its all-time closing high, reached one week ago.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding