Sizing Up Economic Prospects

Published Friday, October 23, 2020, 10:30 p.m. EST

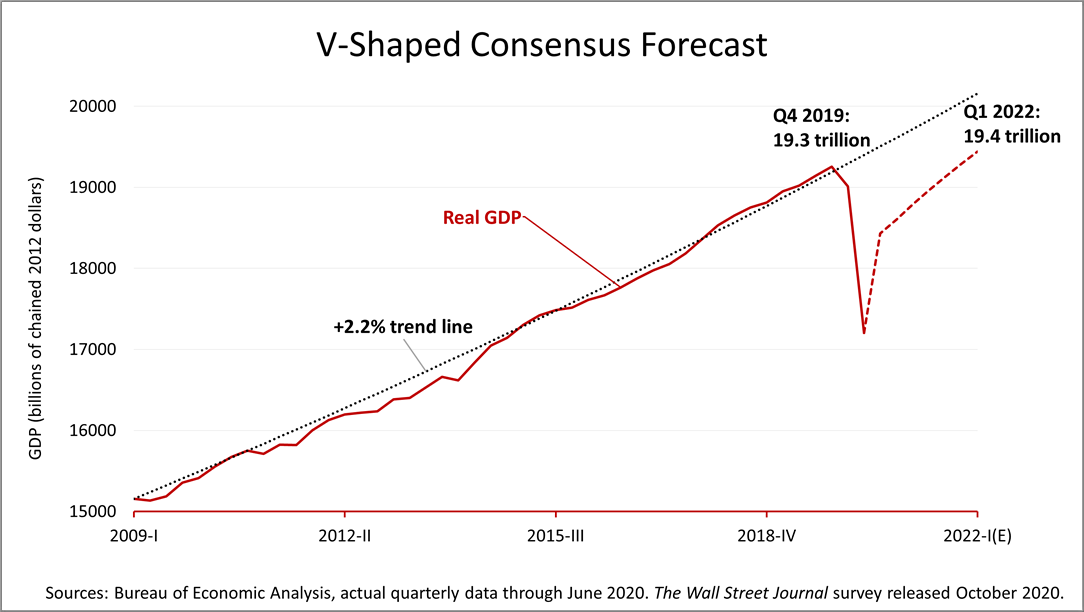

The shape of the economic recovery is coming into clearer focus. Yes, the United States has had a "V-shaped" recovery from the onset of the Covid outbreak in January. However, the right side of the "V" is weakening. A return to the level of prosperity of late 2019 is about 18 months away, while a recovery to the full potential of the U.S. -- in which the unemployment rate drops to 3.5% again -- is at least several years away.

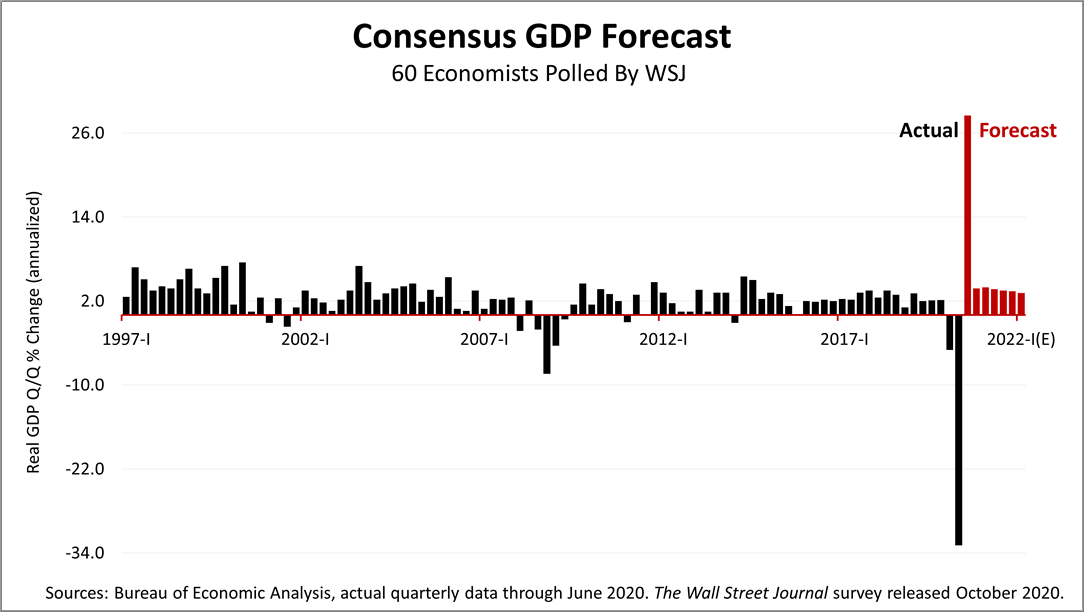

The 60 economists surveyed in mid-October by The Wall Street Journal reportedly expected a U.S. third quarter growth rate of +28.5% over the rate of the third quarter of 2019. (Though the third quarter of 2020 ended September 30, the actual official growth rate is not yet released.

Their outlook was for a sharp deceleration in the fourth quarter to 4% and settling over the next six quarters, to 3.1% in the second quarter of 2022.

The consensus forecast in the dotted lines offers better perspective on the shape of the recovery.

The initial recovery from the pandemic was V-shaped but the deceleration is expected to veer the growth rate to the right.

To get back to the $19.3 trillion economy of late 2019, the experts say, will take until the first quarter of 2022 -- 18 months from now.

To make a full recovery -- as if Covid never happened -- will the red dotted line in this chart would have to meet the grey dotted line. It could be several years off, or longer.

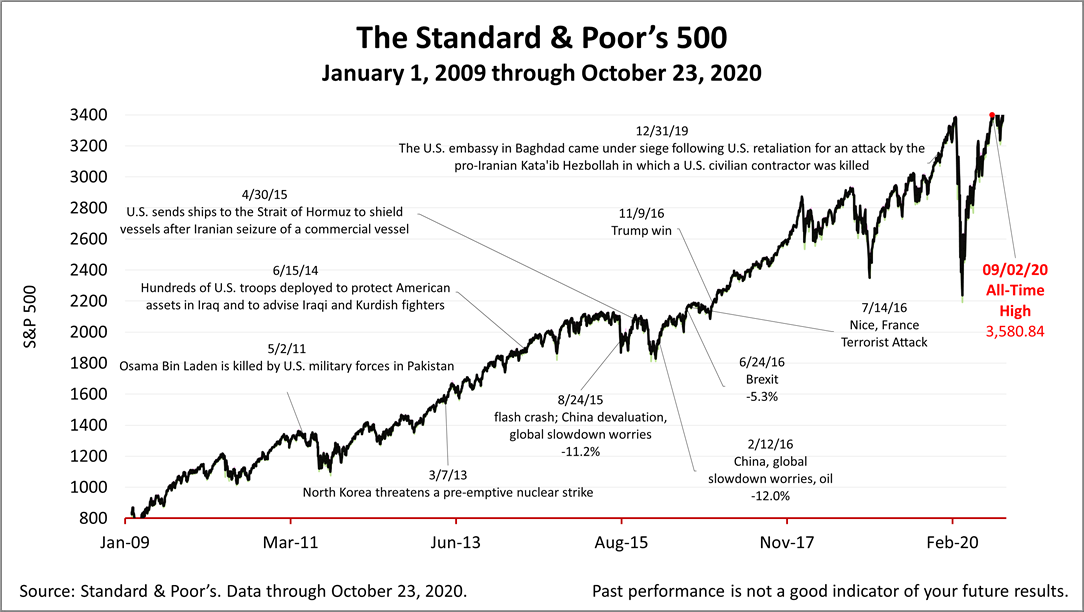

The Standard & Poor's 500 stock index closed Friday at 3,465.39, a gain of +0.34% from Thursday. That was down -0.53% from a week ago. Since the March 23rd bear market low, the S&P 500 soared to return +43.06%.

The half-point drop was the first weekly loss in a month. With an election days and uncertainty over its outcome, a deceleration to the +4% forecasted growth rate in gross domestic product should be comforting to the long-term investment outlook. However, stock prices have swung wildly since the coronavirus crisis hit the stock market early this year and volatility is expected in the months ahead.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding