An Unusual Constellation Of Economic Surprises

Published Friday, December 6, 2019 at: 7:00 AM EST

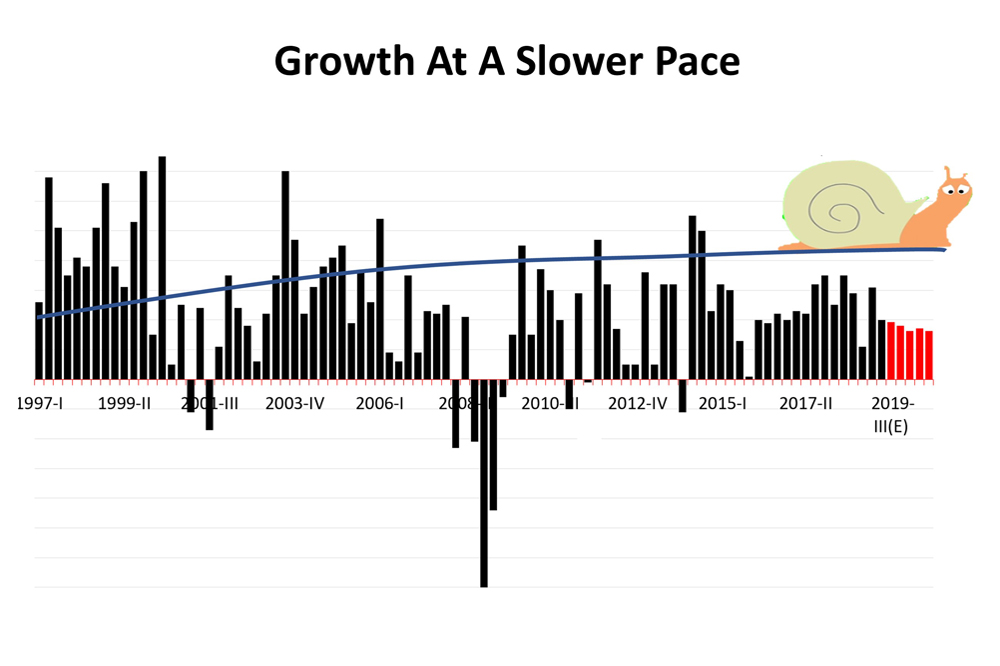

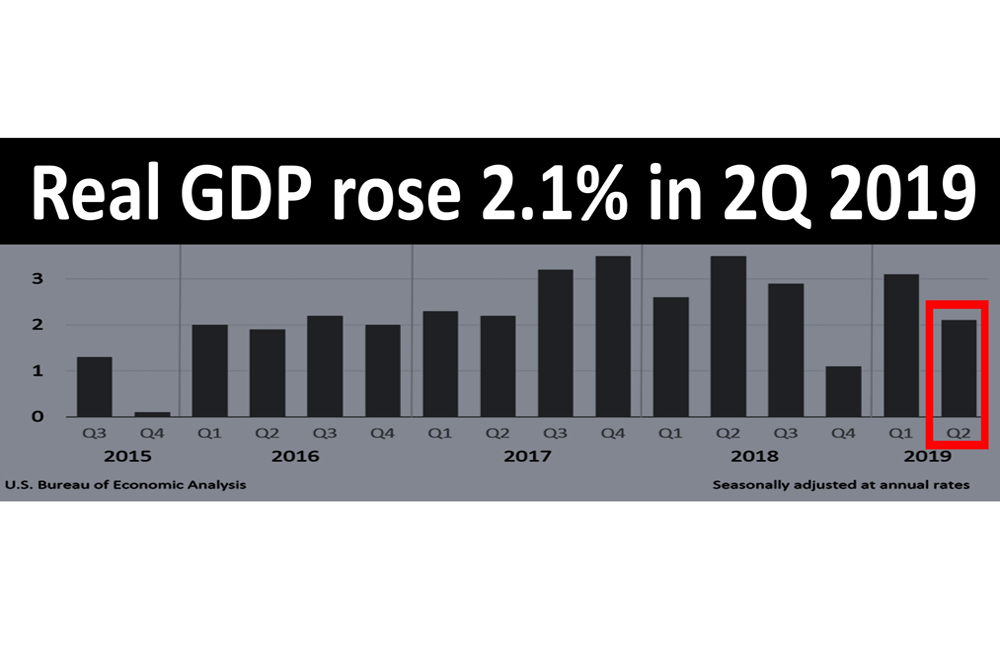

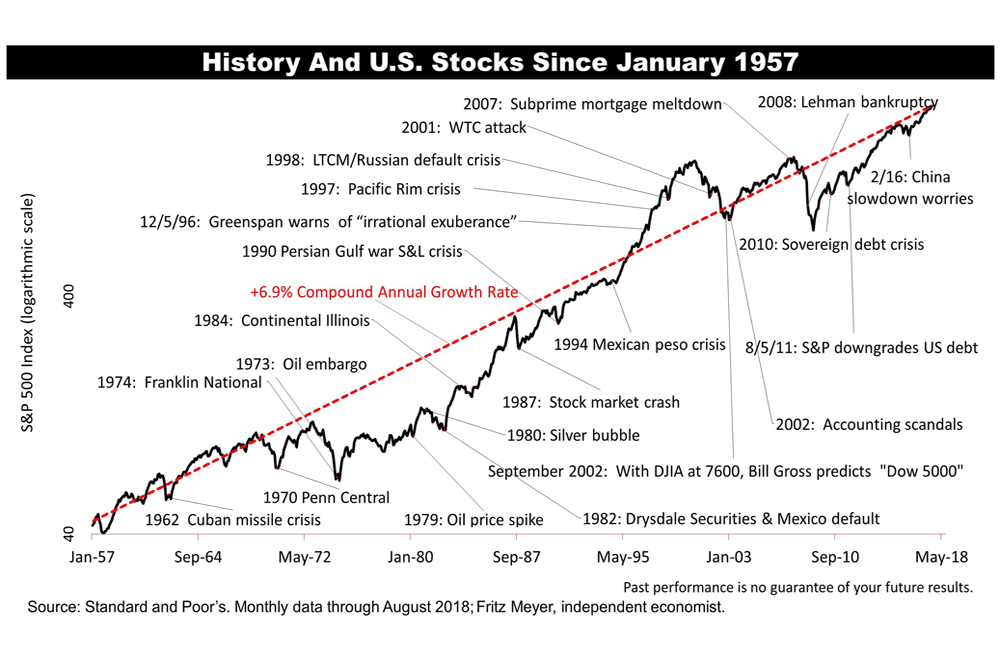

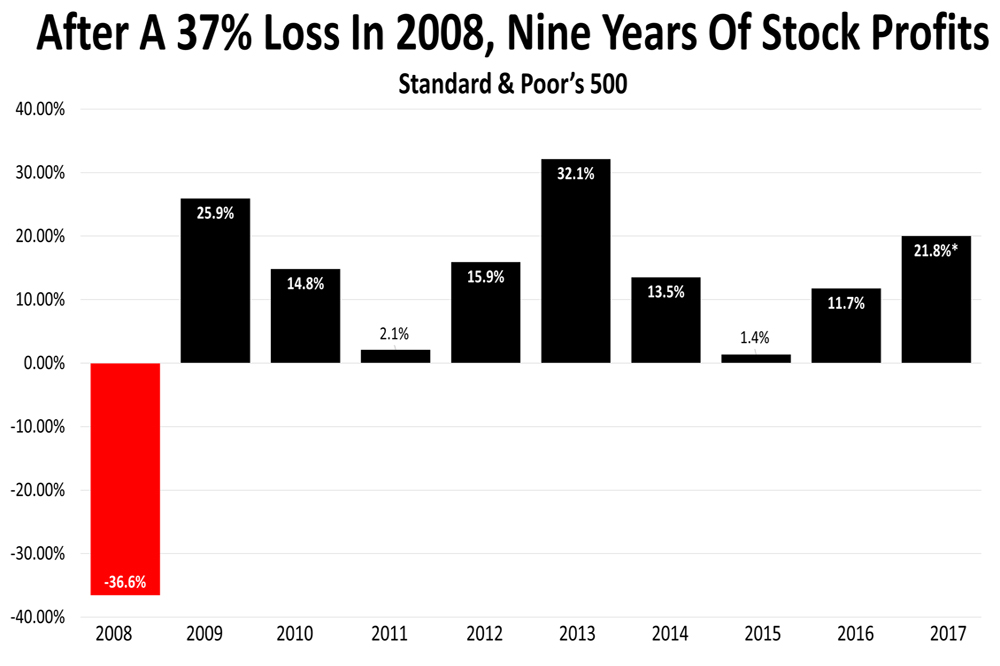

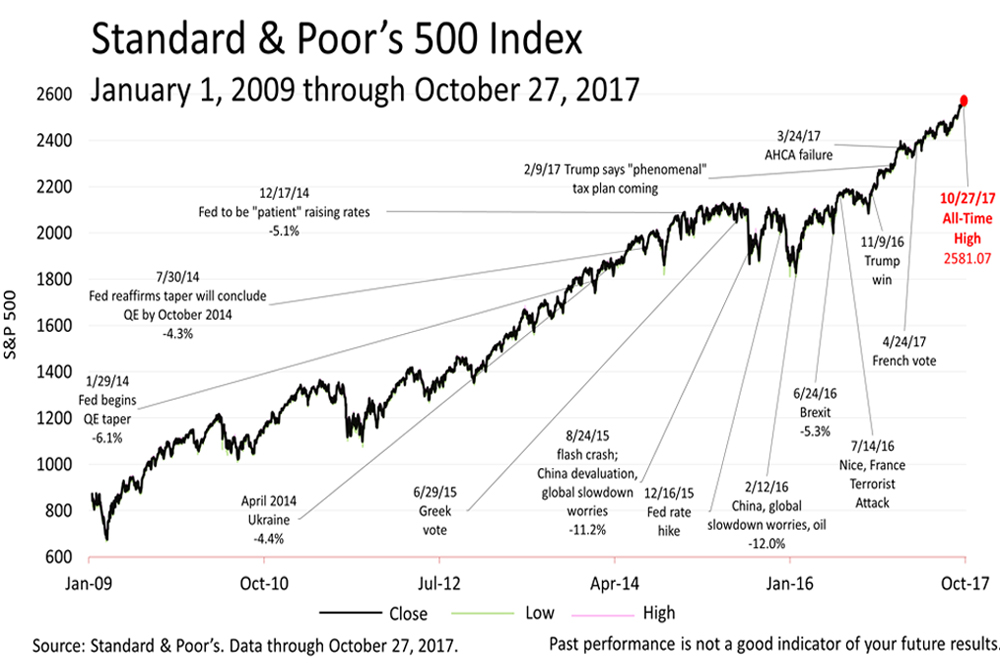

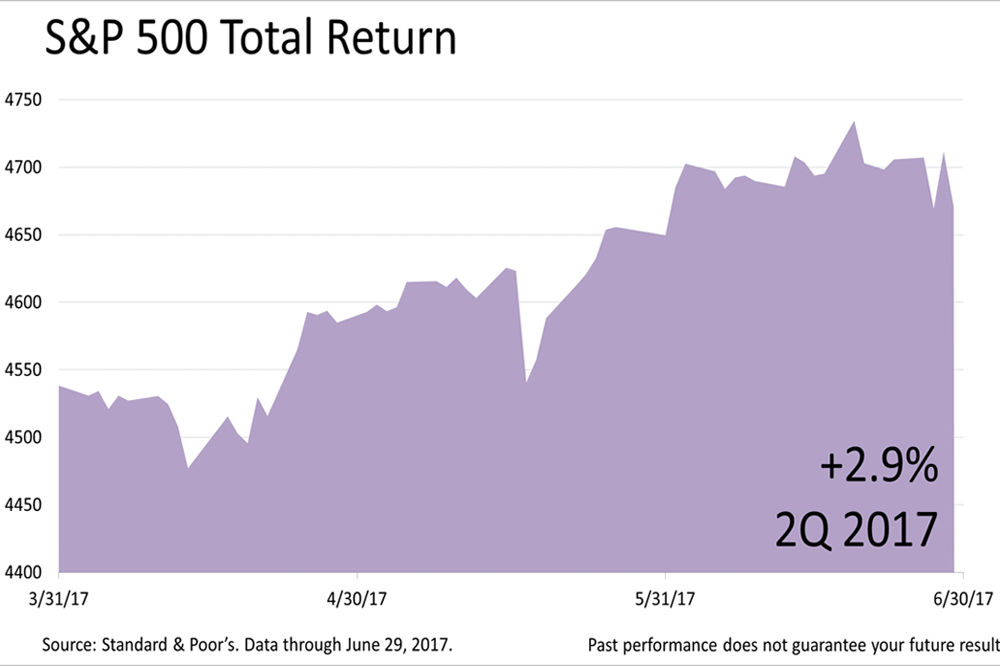

Stocks closed on Friday near an all-time high after a surprisingly strong employment report boosted hopes that the 10½-year expansion — already six months longer than the longest expansion in modern U.S. history — would roar ahead, even as a third of economists reportedly predict a recession in 2020.

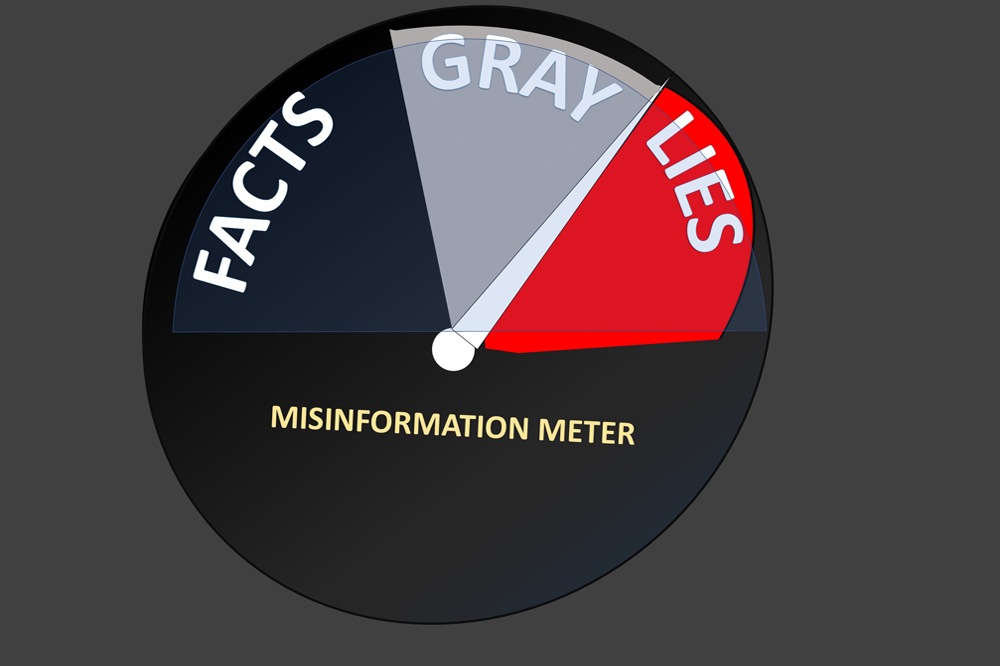

To be clear, a third of the 60 economists surveyed by The Wall Street Journal in early November expect a recession in 2020 and nearly as many (29%) predict a recession by the end of 2021. Yet the economic data week after week for months keeps indicating that no recession is on the horizon.

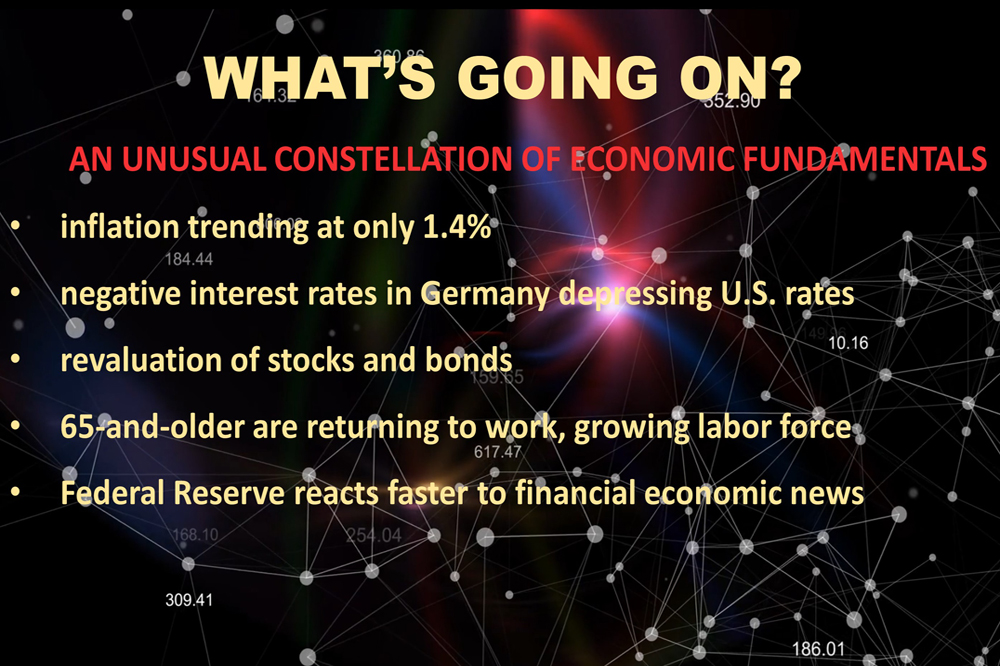

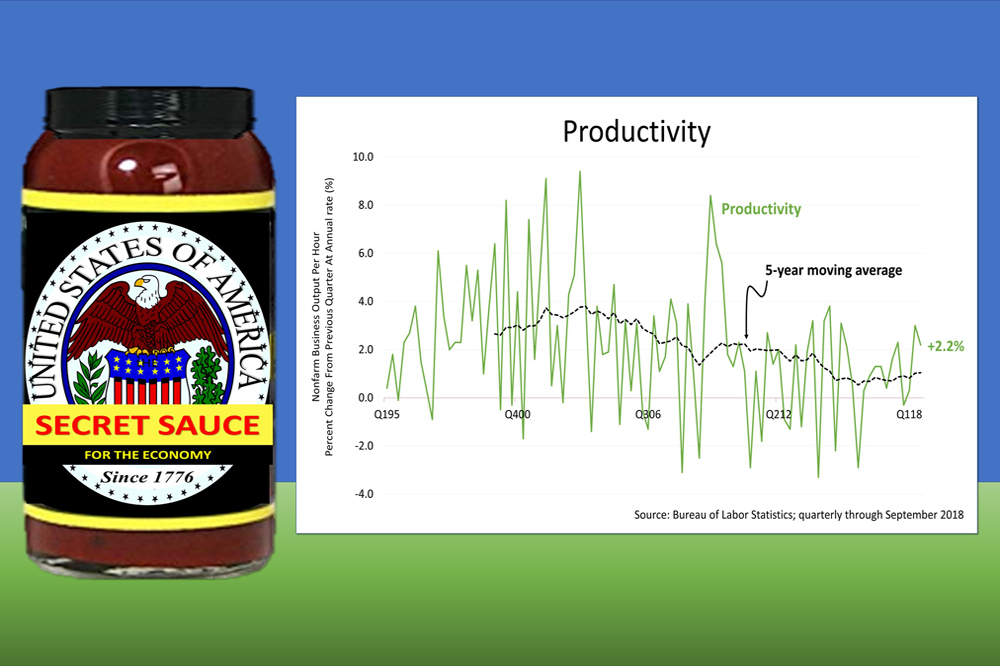

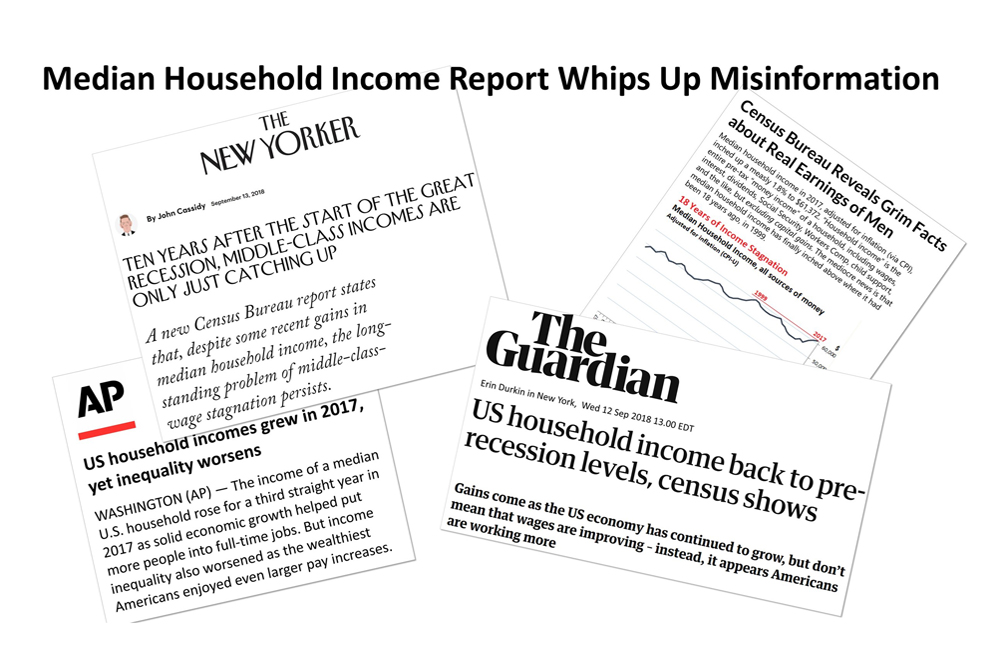

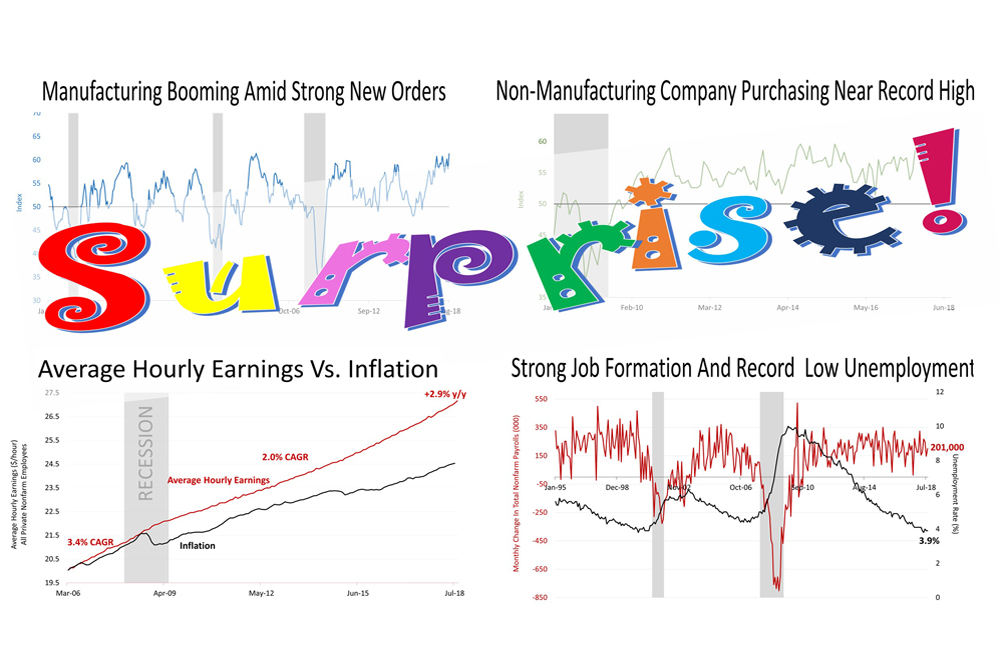

An unusual constellation of economic fundamentals has aligned that's causing surprising changes that confound financial markets, providing unexpectedly good news for U.S. stock investors:

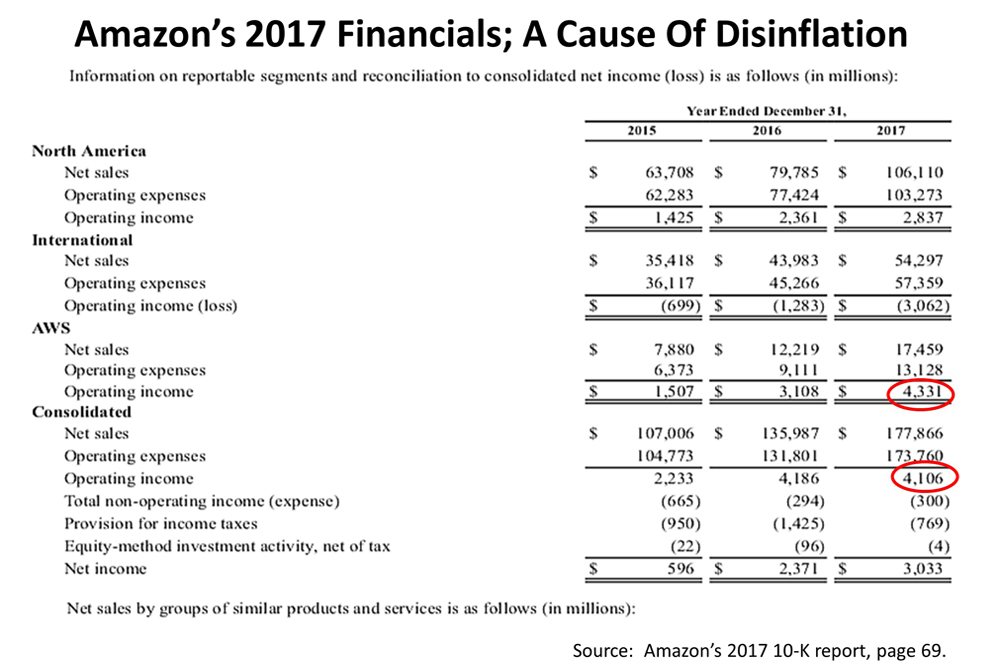

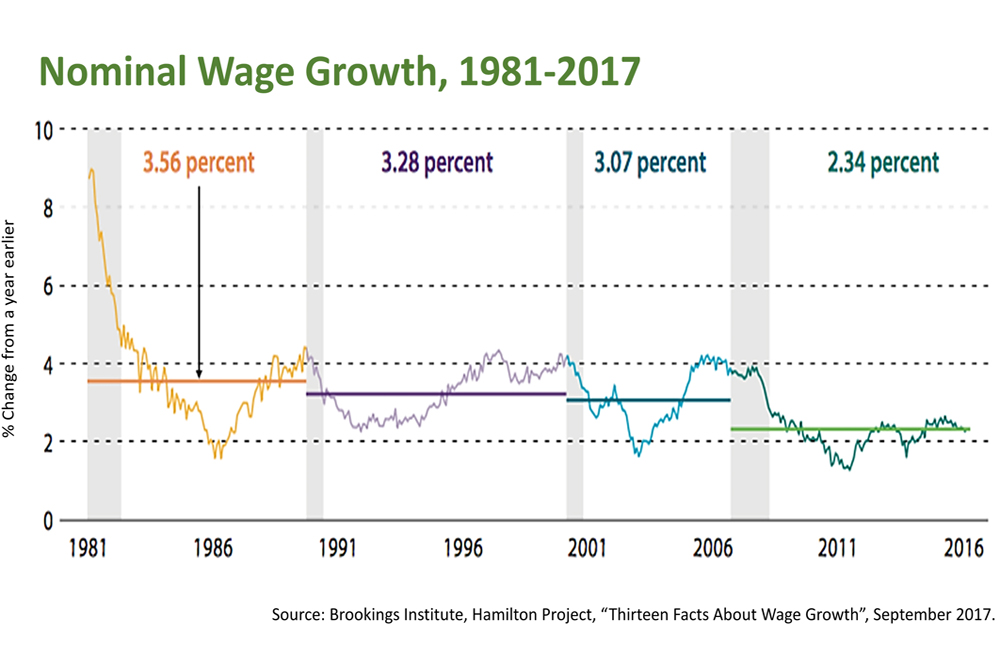

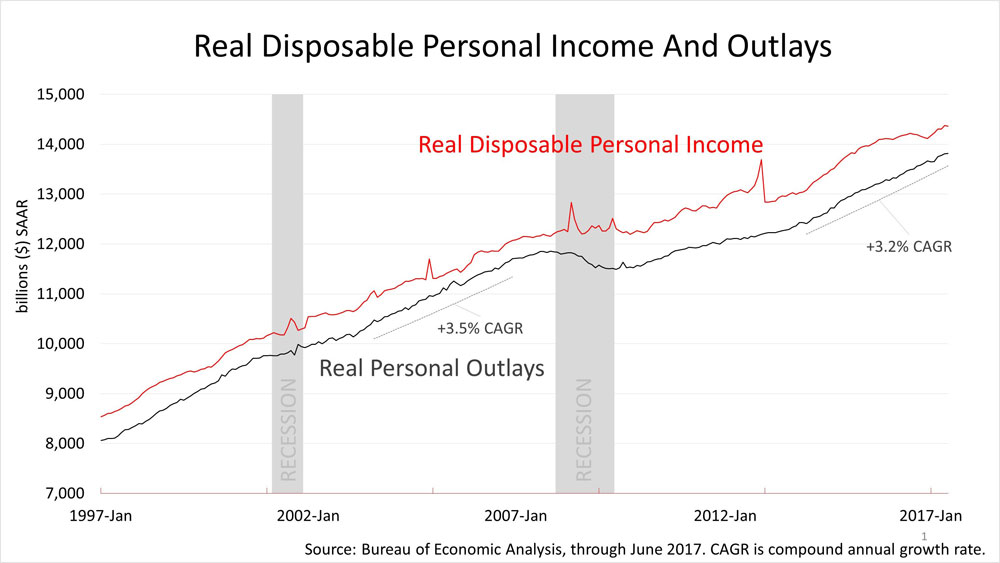

- inflation is trending at 1.4%, lower for years than the Fed expected

- negative interest rates in Germany are depressing U.S. interest rates

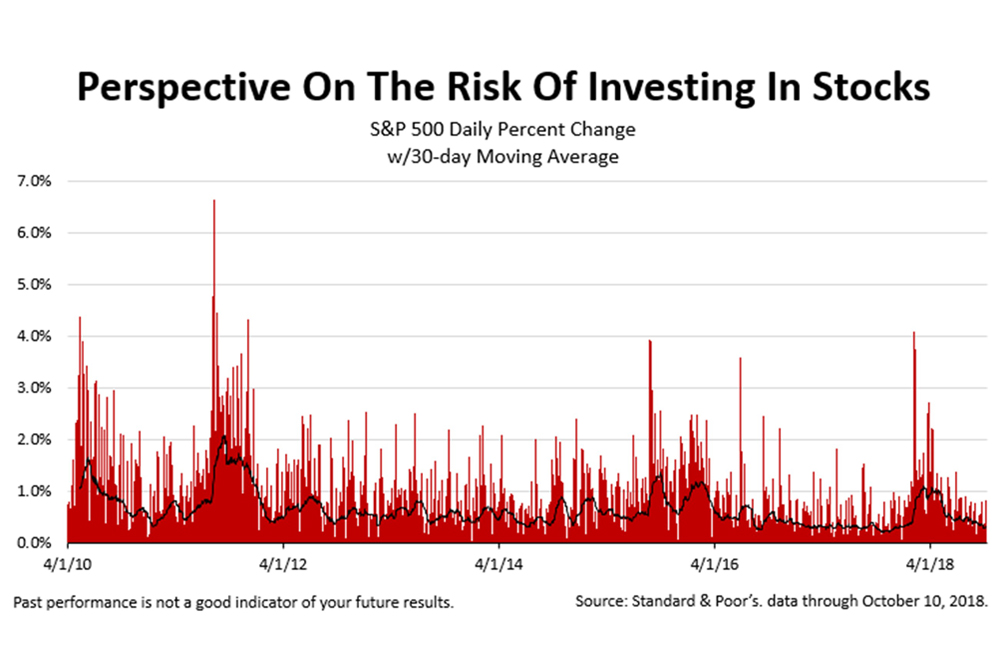

- the prospect of low yields and low inflation is forcing a revaluation in stocks and bonds

- the U.S. labor force is growing because more Americans 65 and older are returning to the labor force

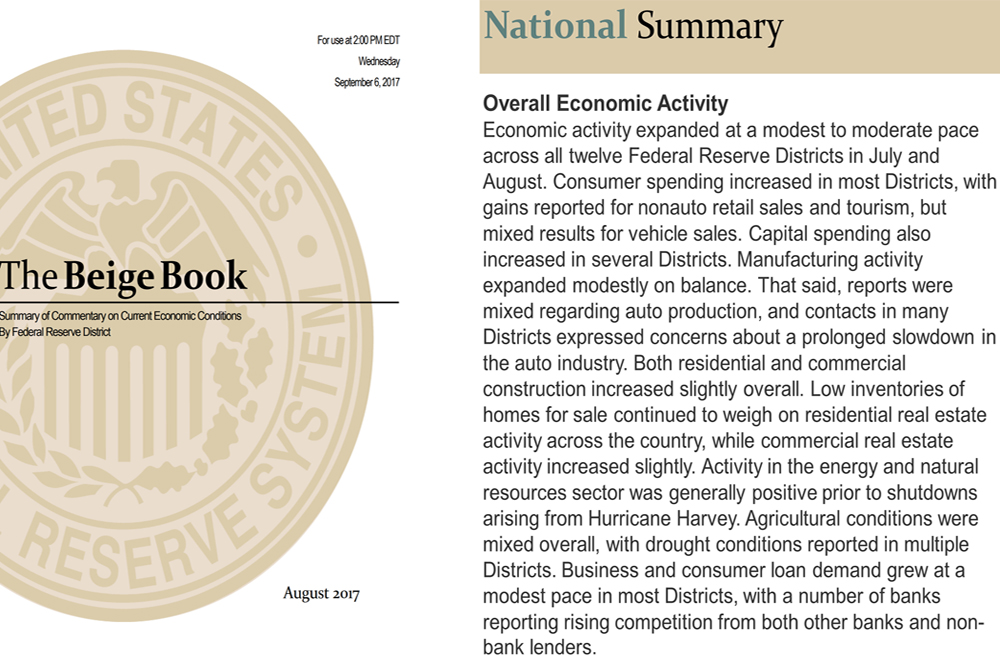

- The Federal Reserve is better at reacting to financial markets and economic conditions

What's going on? What do all the changes mean? It's progress, according to the Standard & Poor's 500 index, which is widely believed to be the best benchmark of financial markets and the progress of civilization, and closed at 3,145.91 on Friday, just a hair off the record set on November 27th.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

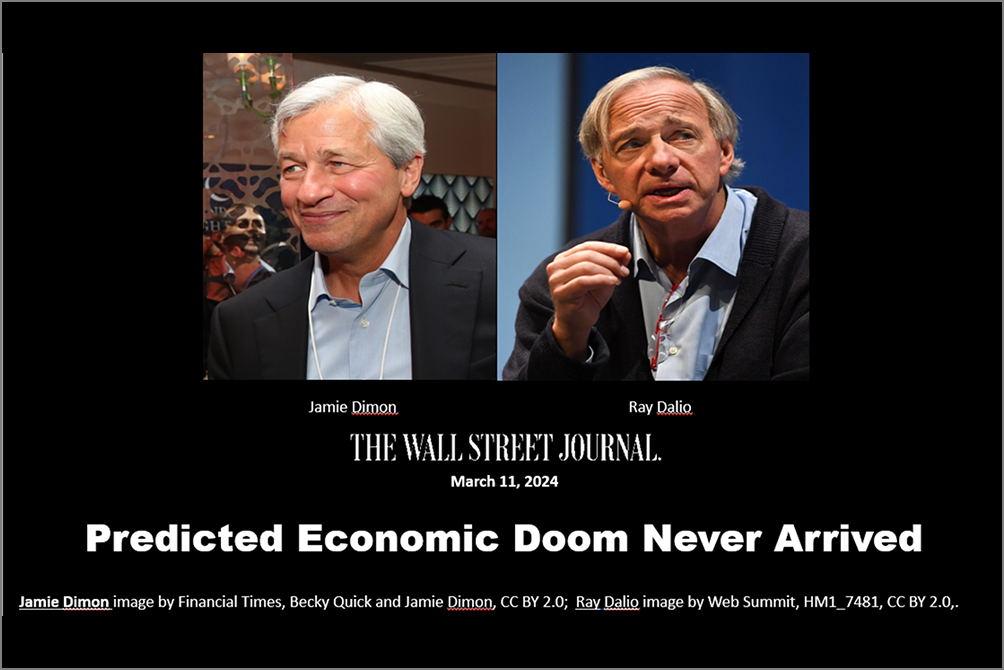

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding