Economy Gets Bad Press Again

Published Friday, September 6, 2019 at: 7:00 AM EDT

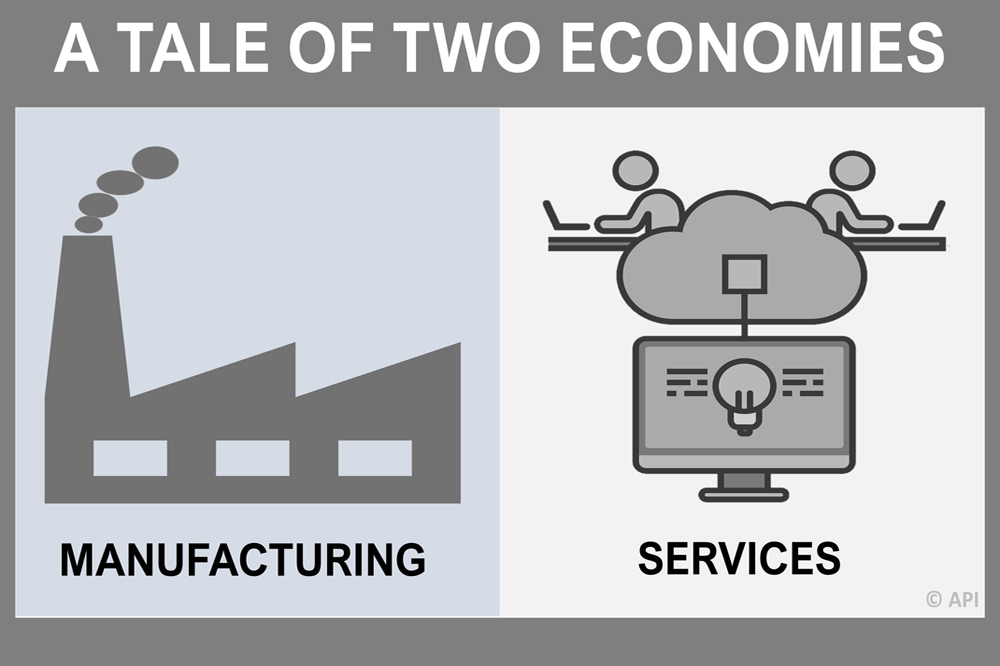

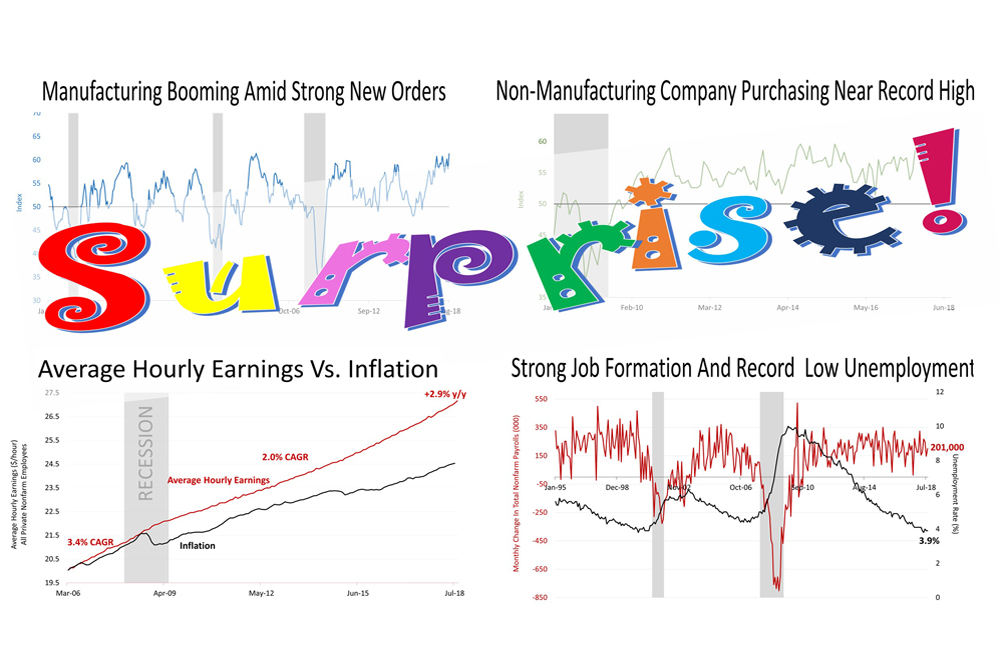

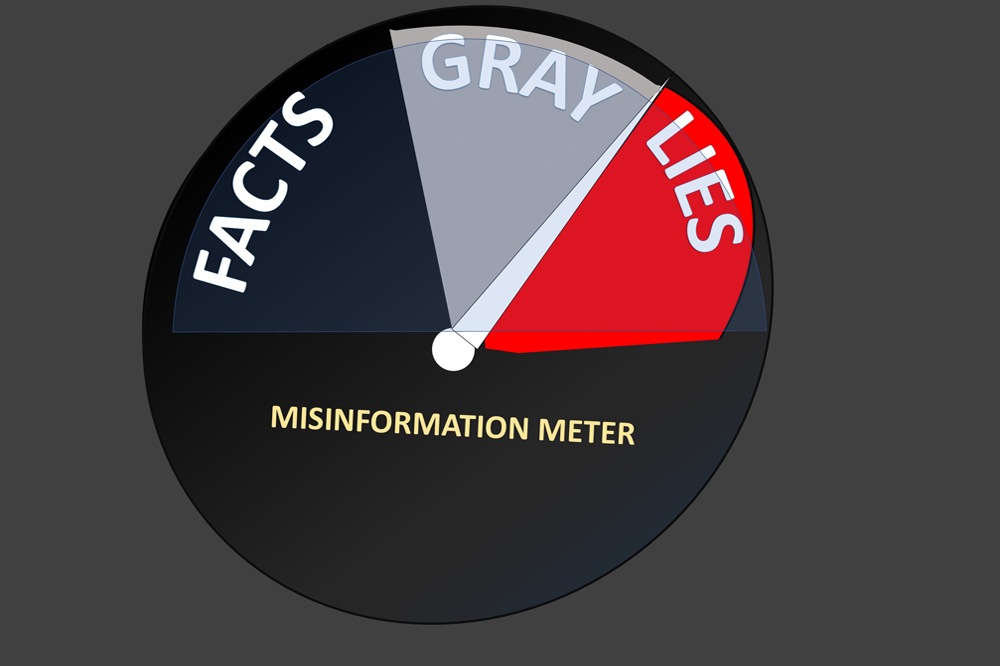

The bad news about the manufacturing sector slowdown is widely sensationalized in the financial press. With the exception of The New York Times, the media coverage of the slump in manufacturing neglected to report the fact that only 11% of the U.S. gross domestic product is derived from manufacturing activity. Without that context, the press would have you think a recession is right around the corner when it's not.

Since September 2018, manufacturing activity plunged from a record-high of 61.3%. Last week's manufacturing activity report showed further deterioration, from 51.2% in July to 49.1% in August, and the press covered it widely.

This monthly manufacturing data series from the Institute of Supply Management, which certifies purchasing management professionals employed across the U.S. and globally, is designed to signal a recession when it falls to less than 50%. In the last three decades, it has predicted six of the last three recessions.

Over the last three economic cycles, the ISM Manufacturing Index dipped below 50% six times and was not followed by a recession three out of those times; rather, it soared again and after it dropped to less than the 50% recession signal.

The drop in manufacturing is not good news, but the press coverage failed to mention that manufacturing is not so important in modern financial U.S. history, as well as the mixed track record of the ISM Index in forecasting a recession.

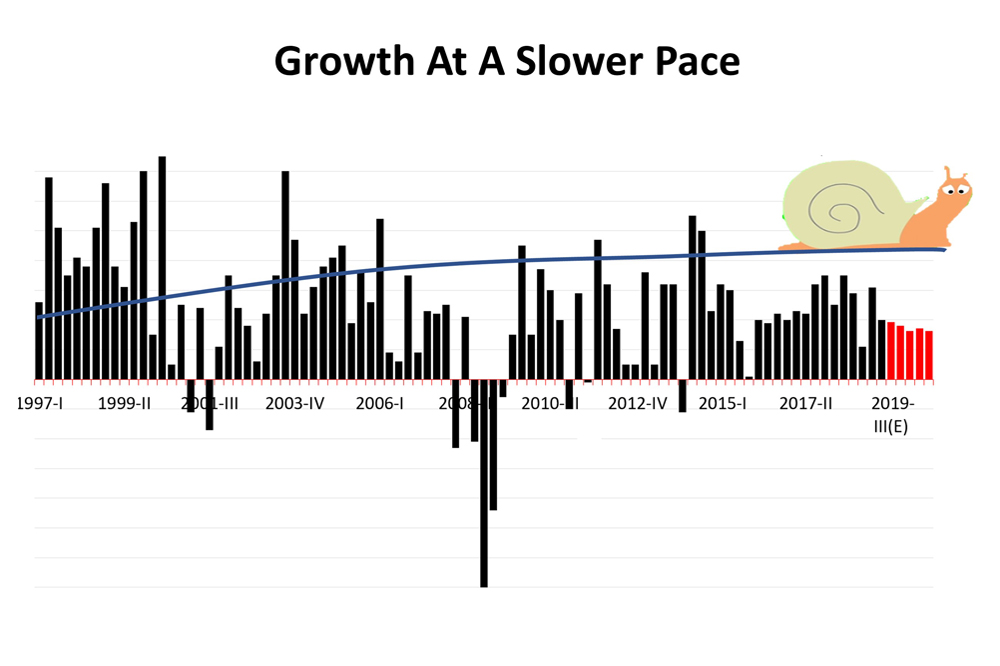

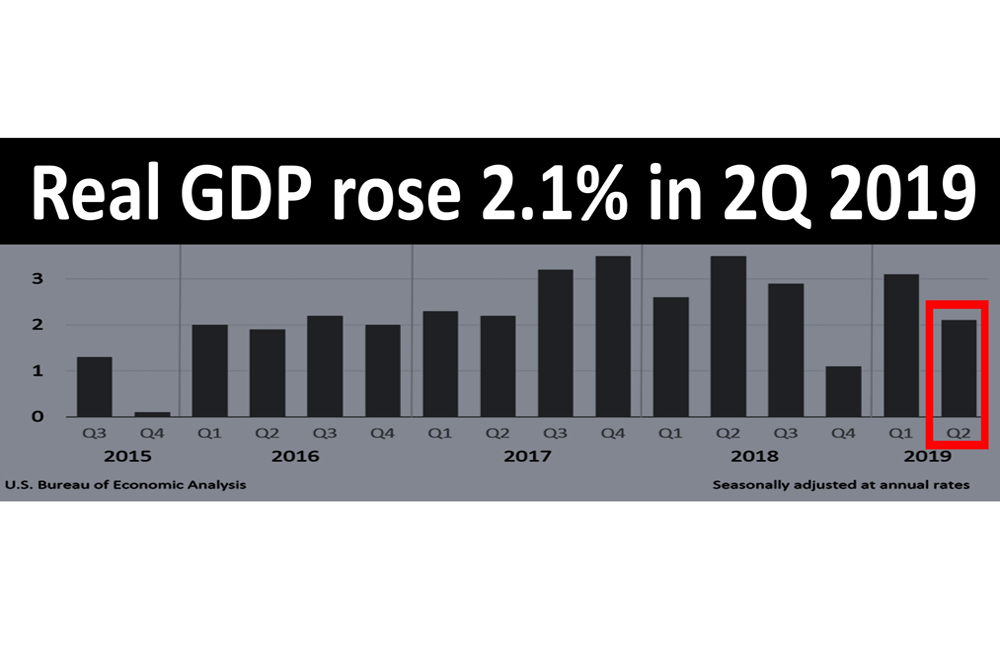

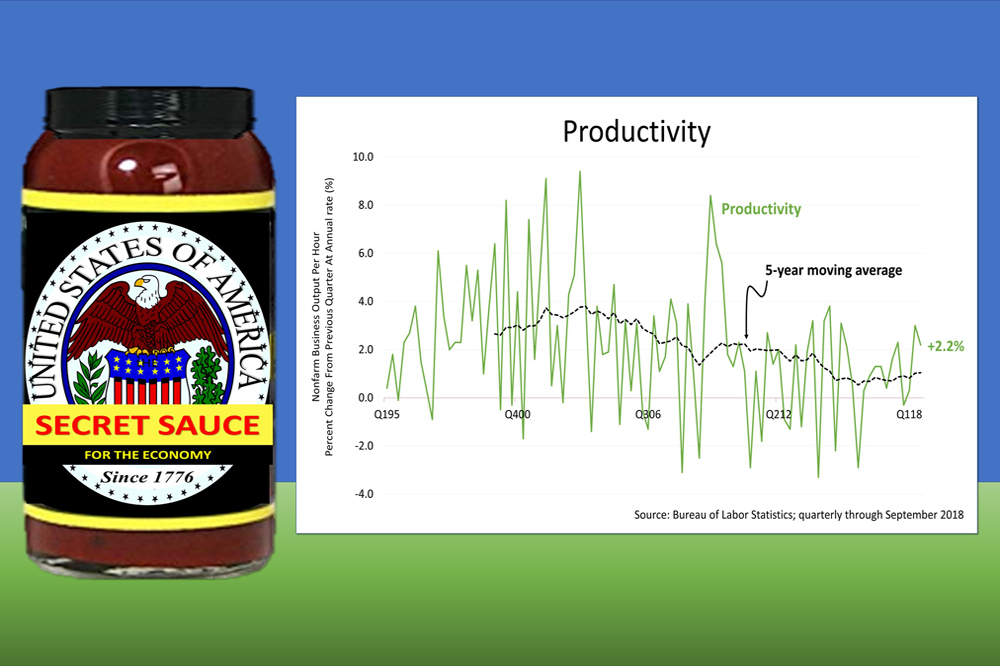

The other big economic news also absent from the financial media arrived August 21st in the non-partisan Congressional Budget Office's quarterly report on the federal budget annual deficit and long-term debt of the United States. The CBO's long-term forecast predicted a 2.3% growth rate for the U.S. in 2019. The 10-year forecast through 2029 is for a 1.8% growth rate but the CBO expects growth in 2019 will be relatively strong, despite the trade-war with China. Based on a search of Google News, this important and good economic news appears not to have made the headlines. The press was understandably focused on the bad long-term financial condition angle in the report. However, the 2019 growth forecast from the CBO confirms that the China trade-war isn't about to sink the economy, though the financial press is dominated by news of the international trade clash.

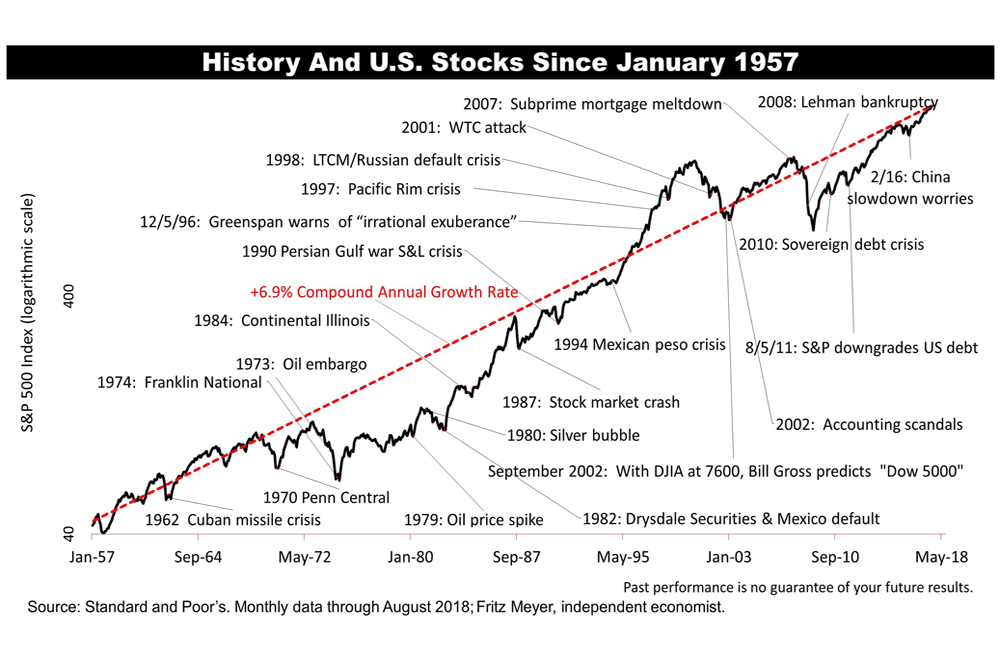

The manufacturing slump, inversion of the yield curve, and trade-war with China have triggered fears of a recession and it's reflected in the press. But the financial press is not comprised of prudent financial professionals and the press is prone to presenting frightening analysis of economic data out of context.

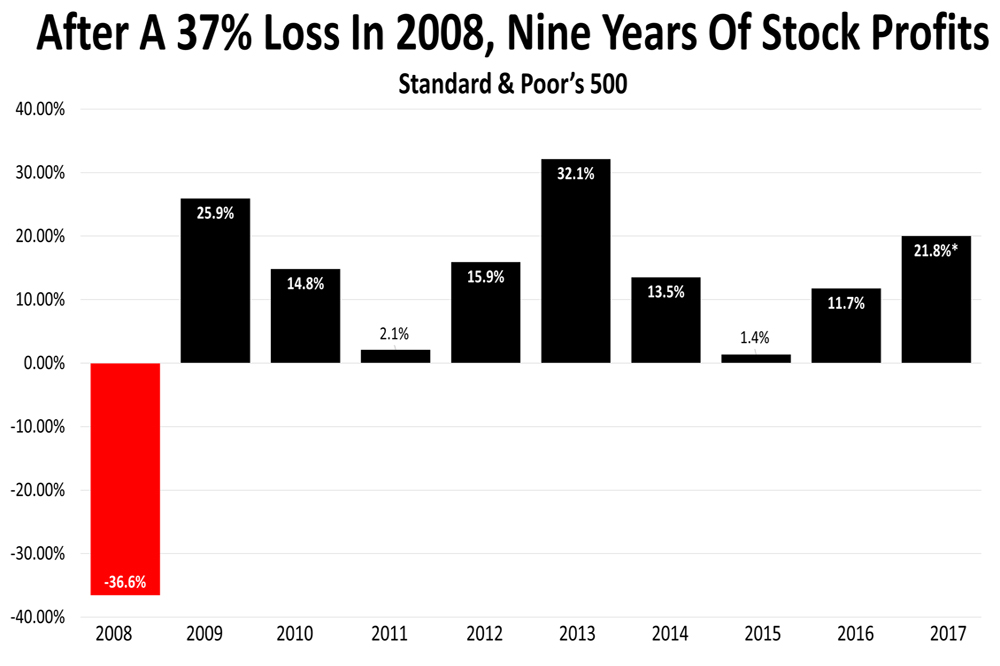

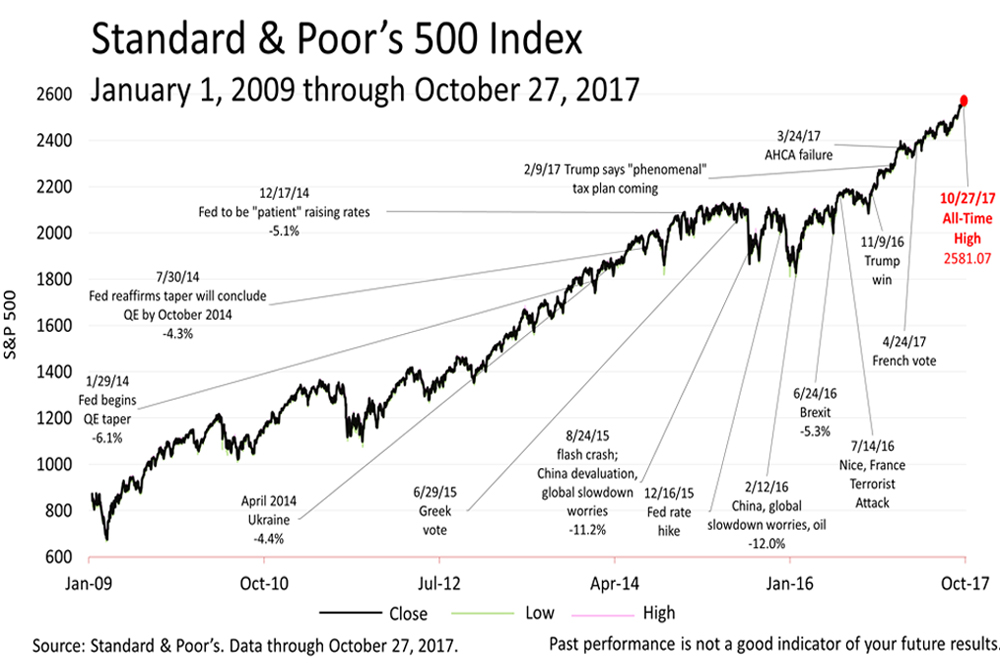

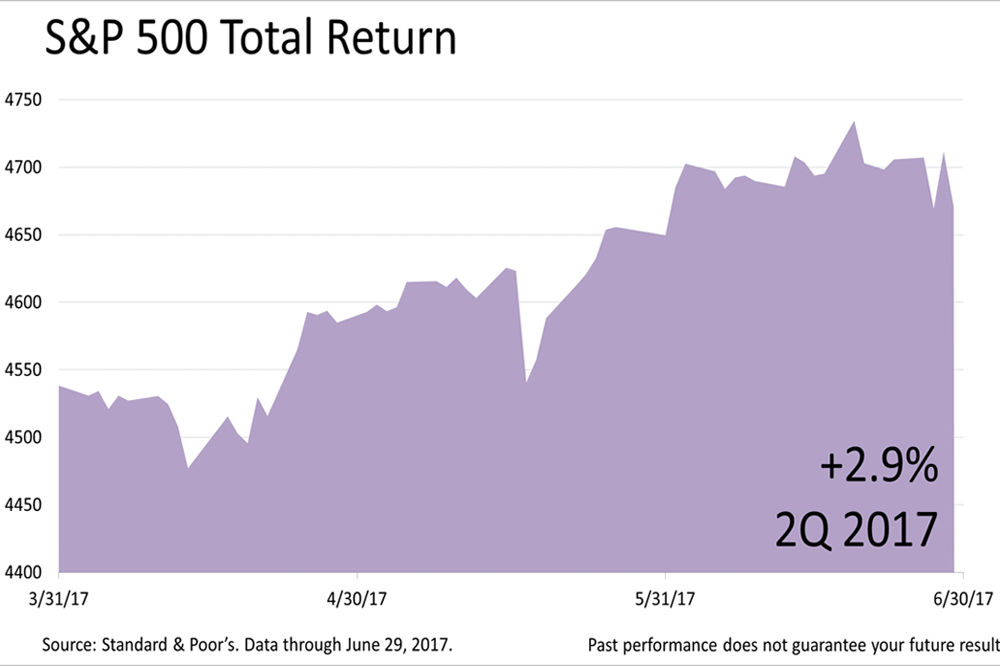

The stock market was not misdirected by the bad press. The Standard & Poor's 500 rose 1.9% for the week to close at 2,978.71, about 2% off its all-time record high, set in July.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

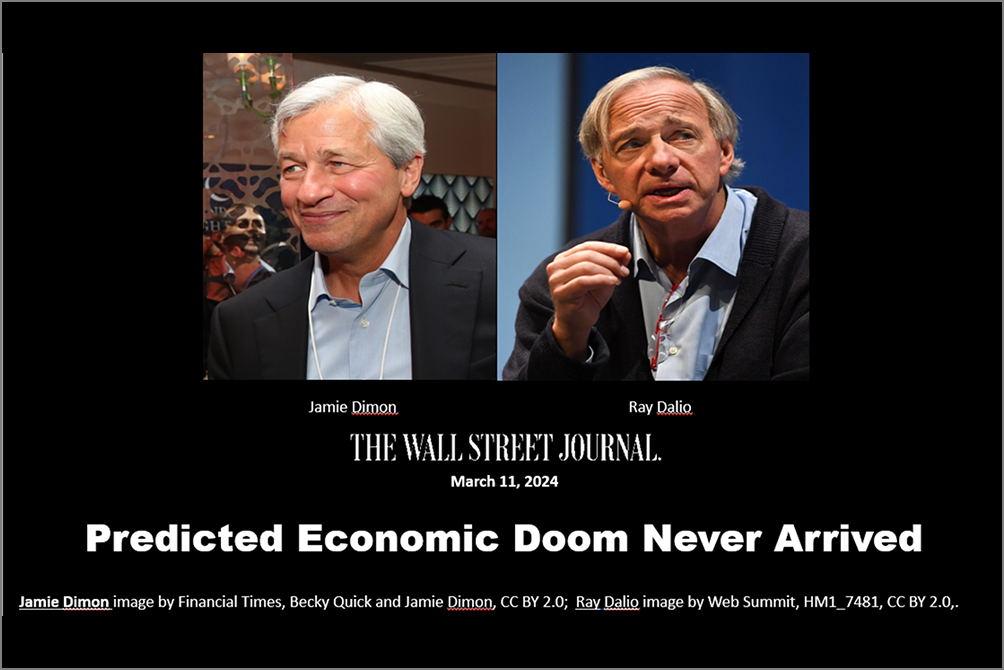

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding