Retail Sales Coverage Reflected The Narrow View Of The Media

Published Friday, October 18, 2019 at: 7:00 AM EDT

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

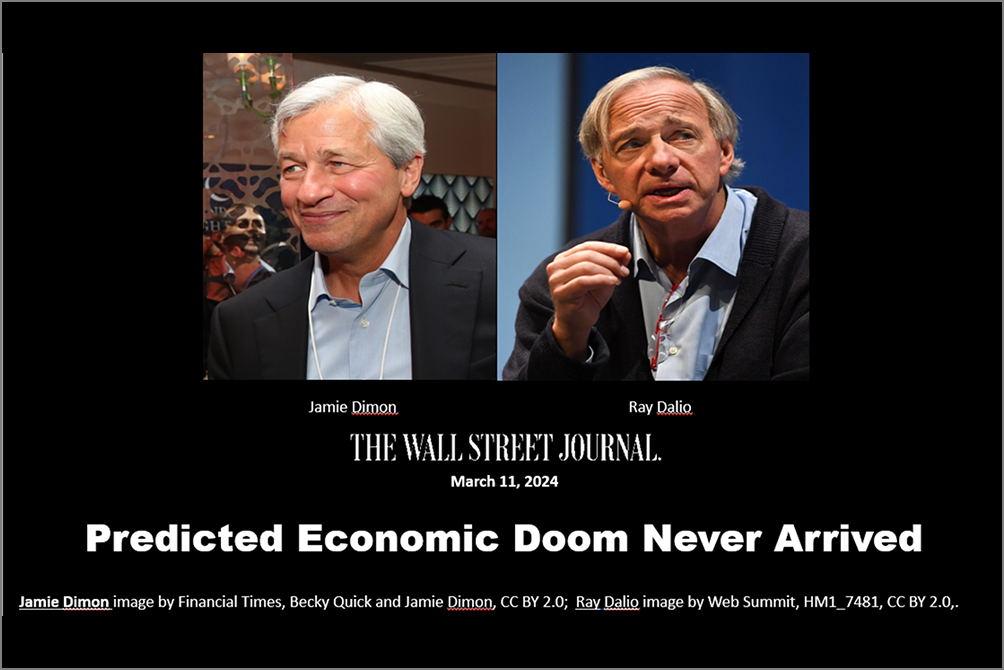

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding