Having Trouble Tuning Out The Bad Financial Economic News?

Published Friday, September 16, 2022 at: 7:32 PM EDT

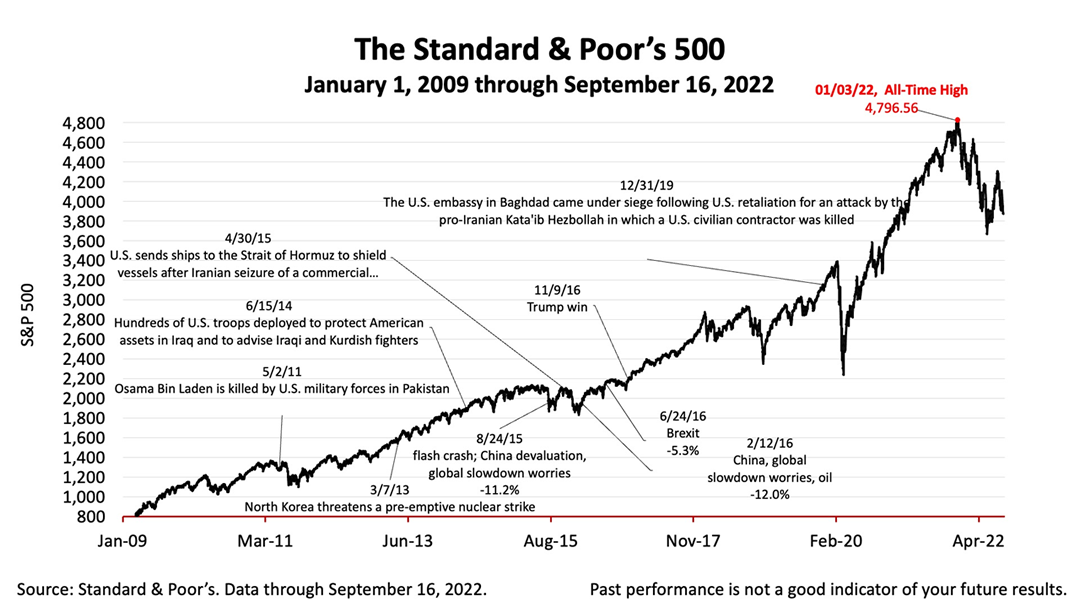

The stock market suffered its worst week since the June 23 bear market, when the Standard & Poor’s stock index fell more than -20% from its all-time high on January 3, 2022.

Try as you might not to pay attention when stocks nosedive and to stick with your strategy to stay invested in stocks for decades, when stocks plunge like they have in this past week, it can make you nervous, and make you rethink your portfolio strategy. Keep in mind:

Doomsday forecasters. In bear markets, doomsday forecasters step up their marketing, get more media attention, and may seem more believable. Some permanent doom and gloom forecasters, who have been wrong about “the coming crash” for many years, nonetheless attract attention with their frightening predictions of a meltdown. While past performance is no guarantee of your future results, the perma-bear doomsayers have been wrong year after year despite periodic corrections and bear market events.

Be Tax-Smart. Be on the lookout for ways you can reduce your taxes between now and the end of the year. With the stock market gyrations this year, realizing a loss on a taxable investment could be advantageous. A $1 long-term capital loss can reduce every dollar of capital gains realized in 2022 and reduce your taxable income by up to $3,000.

Look away. Like rubbernecking, the temptation to look at the daily news reports about the inflation, Federal Reserve policy, supply chain, and Ukraine crises is hard to resist. You can change the channel, turn the page, or not view a post about today’s financial economic news.

Apply a lens. If you need to view the latest news about the confluence of crises for the next few months for your job or to speak intelligently at cocktail parties, view the news skeptically and by applying a historical lens.

Educate yourself. Most crises that are tagged as unprecedented, like the pandemic and post-pandemic inflation, have occurred before. Events that occurred years before anyone living today can remember are much like the pandemic-inflation-Fed tightening cycle propelling today’s economy. History rhymes with today’s news. If you need to keep up with today’s financial economic news, consider learning about similar historical periods. Today’s pandemic, inflation cycle is a lot like the Spanish Influenza of 1918 and the high-inflation period that followed it.

The Standard & Poor’s 500 stock index closed Friday at 3,873.33. The index lost -0.72% from Thursday and -4.77% from last week. It was widely reportedly as the worst weekly loss since mid-June. The index is up +53.54% from the March 23, 2020, bear market low and down -18.7% from its January 3rd all-time high. Volatility is likely to continue in the weeks ahead as the Federal Reserve implements its policy aimed at ending the spate of inflation that’s occurred in the Covid-19 pandemic’s aftermath.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding