Confirming Recovery Is Under Way

Published Friday, August 7, 2020; 9:00 p.m. EST

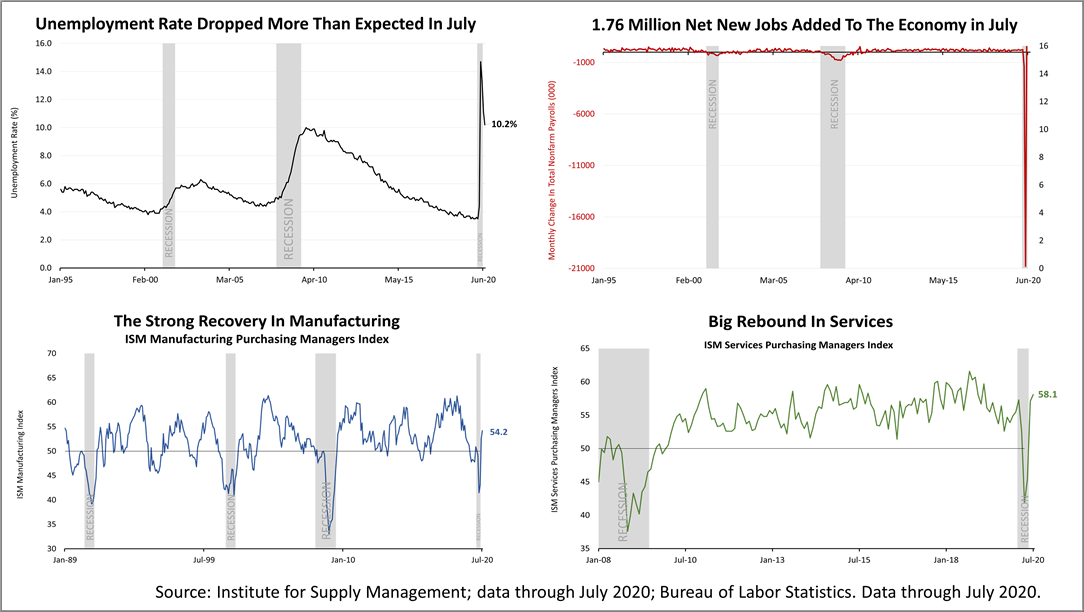

(Friday, August 7, 2020; 9:00 p.m. EST) Confirming a recovery is under way and the recession is ending, the U.S. Labor Department reports 1.76 million net new jobs were created in July and the rate of unemployment dropped to 10.2%.

In addition, strong increases in the service and manufacturing sectors were reported by corporate purchasing managers, according to the Institute of Supply Management, and ISM's forward-looking sub-index measuring new-order activity surged in July.

Improvement in the job situation and corporate purchasing numbers had been expected but the gains were materially stronger than had been expected by economists.

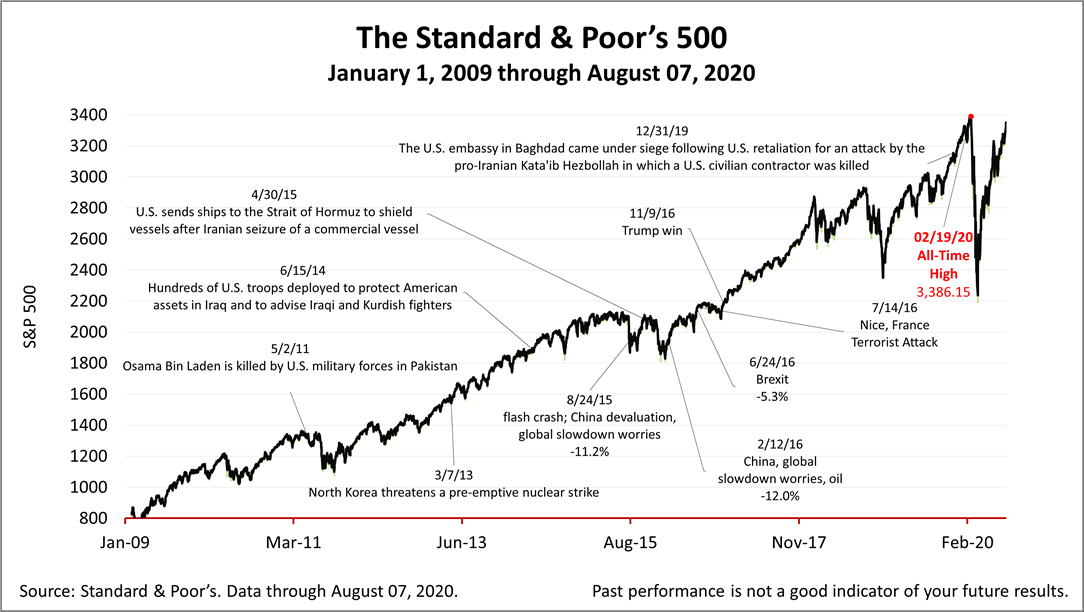

08/07/2020 closing number: 3,351.28

The Covid-crisis recession and recovery are unprecedented in modern U.S. history, making precise predictions tenuous. But the job situation and corporate purchasing manager data have been better than expected for two months.

The Standard & Poor's 500 stock index closed Friday at 3,351.28, up six-tenths of 1% for the day, +2.42% from a week ago, and +39.86% than its March 23rd bear market low.

Stock prices have swung wildly since the crisis started in March. Drops of as much as7% in one day have occurred in this period and volatility is to be expected in the months ahead.

For tax purposes, this is good time to consider certain strategies, including conversion to a Roth IRA from a traditional IRA, or gifting assets to children and grandchildren.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial situation, or particular needs. Product suitability must be independently determined for each individual investor.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding