Bad Inflation Surprise Sends Stocks Down Sharply

Published Friday, June 10, 2022 at: 8:02 PM EDT

The inflation crisis of 2022 grew more fearsome with Friday’s release by the U.S. Bureau of Labor Statistics of a worse-than-expected consumer price index (CPI) report. For the 12 months through May 2022, CPI shot +8.6% higher, the highest rate since the inflation crisis of the late 1970s and early 1980s.

Higher gas prices are the main factor. Meanwhile, other threats to U.S. economic growth linger, including the war in Ukraine, supply chain bottlenecks, and Covid subvariants. The unusual turbulence shortens runway room for a soft-landing and increases the chance of a recession, but the Federal Reserve still has a chance of convincing consumers that it will end inflation fast.

The Fed hiked rates a half-point on May 4. It’s expected to announce another half-point hike on Wednesday, June 15. Yet another hike is expected on July 27, and Friday’s worse-than-expected CPI release makes yet another half-point hike on September 21 more likely.

Friday’s bad CPI surprise came after a last week’s positive report on the Fed’s favored benchmark of inflation, the Personal Consumption Expenditure Deflater (PCED) index, registered a decline. That had raised hopes that a peak in inflation had occurred. Instead, the CPI increase in May was as bad as in April, rising by six-tenths of 1%.

Keeping the latest economic news in perspective, it’s important to remember that last week’s release of the Purchasing Managers Index (PMI) in the service sector, settled at its long-term historic norm. Services account for 89% of U.S. economic activity. In addition, the latest Leading Economic Indicator Index for the U.S. in line with long-term expectations for gross domestic product growth of 2.2%, unemployment remains very low, new-job creation is strong, and consumer balance sheets are strong. Thus, a soft landing could still unfold, or a short, mild recession.

Speculation about the Fed’s next move is a hot topic on cable TV, national newspaper, and social media networks. The Fed could hike rates more than a half-point on Wednesday. Seventy-five basis-point hikes are extremely rare but could occur on Wednesday. Or the Fed may not wait till Wednesday by raising rates this weekend. Exactly how the Fed will convince the nation that it will end inflation is unknown, but the Fed ultimately has always found a way to kill the scourge, even if it meant a recession.

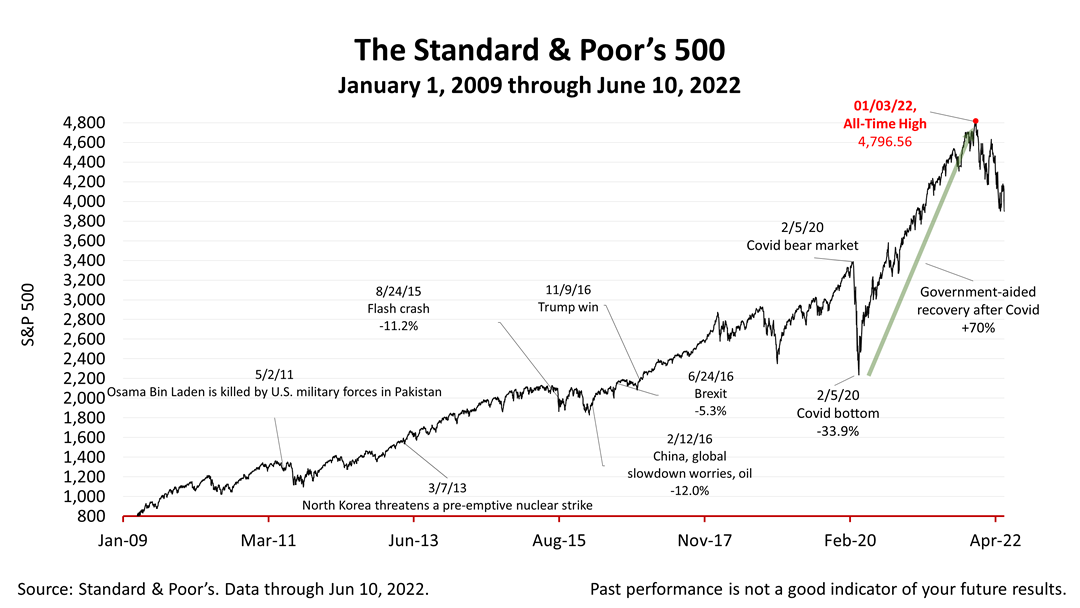

Inflation uncertainty sent the stock market tumbling today by -2.9%. The Standard & Poor’s 500 stock index closed this Friday at 3,900.86. The index dropped -5.18% from last week. The index is up +54.2% from the March 23, 2020, bear market low and down -20.6% from the January 3rd all-time high.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding